Ipca Laboratories' (NSE:IPCALAB) Solid Earnings Have Been Accounted For Conservatively

The market seemed underwhelmed by the solid earnings posted by Ipca Laboratories Limited (NSE:IPCALAB) recently. Along with the solid headline numbers, we think that investors have some reasons for optimism.

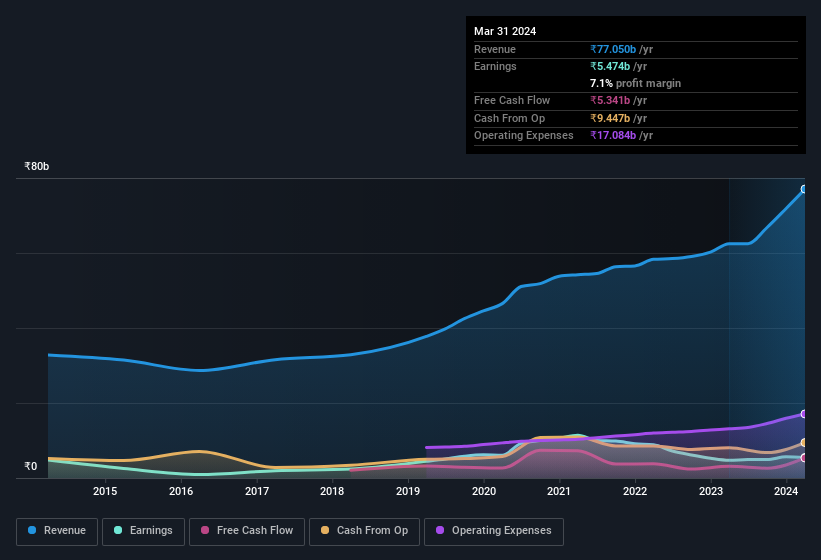

See our latest analysis for Ipca Laboratories

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Ipca Laboratories' profit was reduced by ₹1.1b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Ipca Laboratories to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ipca Laboratories' Profit Performance

Because unusual items detracted from Ipca Laboratories' earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Ipca Laboratories' statutory profit actually understates its earnings potential! And the EPS is up 16% over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 1 warning sign for Ipca Laboratories you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Ipca Laboratories' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IPCALAB

Ipca Laboratories

An integrated pharmaceutical company, manufactures and markets formulations and active pharmaceutical ingredients (APIs) for various therapeutic segments in India, Europe, Africa, the Americas, Asia, the Commonwealth of Independent States, and Australasia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026