Did You Miss Indoco Remedies' (NSE:INDOCO) 37% Share Price Gain?

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Indoco Remedies Limited (NSE:INDOCO) share price is 37% higher than it was a year ago, much better than the market return of around 21% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 15% higher than it was three years ago.

See our latest analysis for Indoco Remedies

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

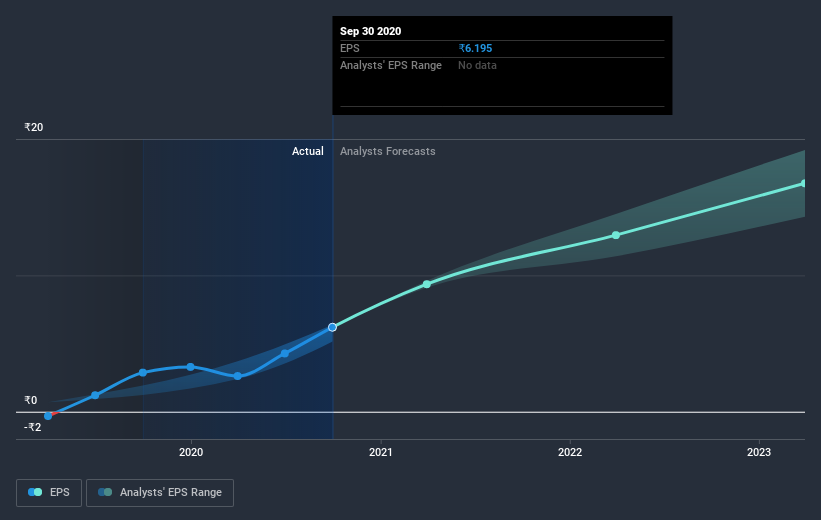

Indoco Remedies was able to grow EPS by 116% in the last twelve months. It's fair to say that the share price gain of 37% did not keep pace with the EPS growth. So it seems like the market has cooled on Indoco Remedies, despite the growth. Interesting. Of course, with a P/E ratio of 50.91, the market remains optimistic.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Indoco Remedies has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's nice to see that Indoco Remedies shareholders have received a total shareholder return of 37% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Indoco Remedies scores on these 3 valuation metrics.

But note: Indoco Remedies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Indoco Remedies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:INDOCO

Indoco Remedies

Manufactures, markets, and sells formulations and active pharmaceutical ingredients in India and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives