These 4 Measures Indicate That Hester Biosciences (NSE:HESTERBIO) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hester Biosciences Limited (NSE:HESTERBIO) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hester Biosciences

What Is Hester Biosciences's Net Debt?

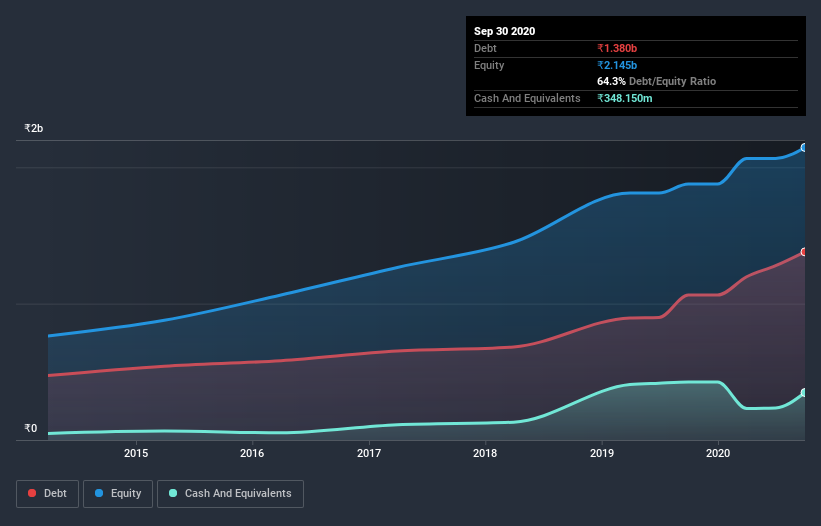

As you can see below, at the end of September 2020, Hester Biosciences had ₹1.37b of debt, up from ₹1.06b a year ago. Click the image for more detail. However, it also had ₹348.2m in cash, and so its net debt is ₹1.03b.

How Strong Is Hester Biosciences's Balance Sheet?

According to the last reported balance sheet, Hester Biosciences had liabilities of ₹791.3m due within 12 months, and liabilities of ₹1.40b due beyond 12 months. Offsetting this, it had ₹348.2m in cash and ₹544.6m in receivables that were due within 12 months. So it has liabilities totalling ₹1.30b more than its cash and near-term receivables, combined.

Since publicly traded Hester Biosciences shares are worth a total of ₹15.4b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a debt to EBITDA ratio of 1.7, Hester Biosciences uses debt artfully but responsibly. And the alluring interest cover (EBIT of 7.2 times interest expense) certainly does not do anything to dispel this impression. Importantly, Hester Biosciences's EBIT fell a jaw-dropping 23% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is Hester Biosciences's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, Hester Biosciences actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Hester Biosciences's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Hester Biosciences's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Hester Biosciences (of which 1 is significant!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Hester Biosciences, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hester Biosciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hester Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:HESTERBIO

Hester Biosciences

Manufactures and trades in veterinary vaccines and animal health products in India and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives