Hester Biosciences Limited's (NSE:HESTERBIO) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

Hester Biosciences (NSE:HESTERBIO) has had a rough month with its share price down 2.4%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on Hester Biosciences' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Hester Biosciences

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hester Biosciences is:

13% = ₹284m ÷ ₹2.1b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every ₹1 worth of shareholders' equity, the company generated ₹0.13 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Hester Biosciences' Earnings Growth And 13% ROE

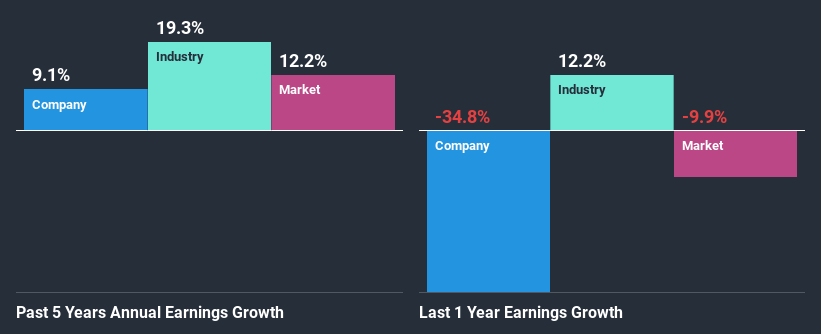

When you first look at it, Hester Biosciences' ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 8.3%, is definitely interesting. This probably goes some way in explaining Hester Biosciences' moderate 9.1% growth over the past five years amongst other factors. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Therefore, the growth in earnings could also be the result of other factors. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

As a next step, we compared Hester Biosciences' net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 21% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Hester Biosciences fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hester Biosciences Making Efficient Use Of Its Profits?

Hester Biosciences has a low three-year median payout ratio of 23%, meaning that the company retains the remaining 77% of its profits. This suggests that the management is reinvesting most of the profits to grow the business.

Moreover, Hester Biosciences is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

Overall, we feel that Hester Biosciences certainly does have some positive factors to consider. Specifically, we like that the company is reinvesting a huge chunk of its profits at a respectable rate of return. This of course has caused the company to see a good amount of growth in its earnings. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 3 risks we have identified for Hester Biosciences.

When trading Hester Biosciences or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hester Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HESTERBIO

Hester Biosciences

Manufactures and trades in veterinary vaccines and animal health products in India and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives