Earnings Tell The Story For Eris Lifesciences Limited (NSE:ERIS)

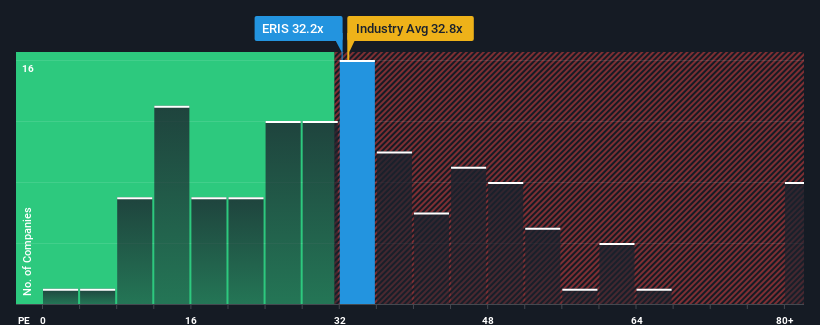

There wouldn't be many who think Eris Lifesciences Limited's (NSE:ERIS) price-to-earnings (or "P/E") ratio of 32.2x is worth a mention when the median P/E in India is similar at about 29x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Eris Lifesciences' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Eris Lifesciences

How Is Eris Lifesciences' Growth Trending?

Eris Lifesciences' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.6%. Regardless, EPS has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the twelve analysts watching the company. With the market predicted to deliver 19% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Eris Lifesciences' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Eris Lifesciences' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Eris Lifesciences maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Eris Lifesciences that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Eris Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ERIS

Eris Lifesciences

Provides domestic branded formulations for chronic and sub-chronic therapies in India and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives