There's A Lot To Like About Concord Biotech's (NSE:CONCORDBIO) Upcoming ₹10.70 Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Concord Biotech Limited (NSE:CONCORDBIO) is about to trade ex-dividend in the next 3 days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Concord Biotech's shares on or after the 3rd of September, you won't be eligible to receive the dividend, when it is paid on the 9th of October.

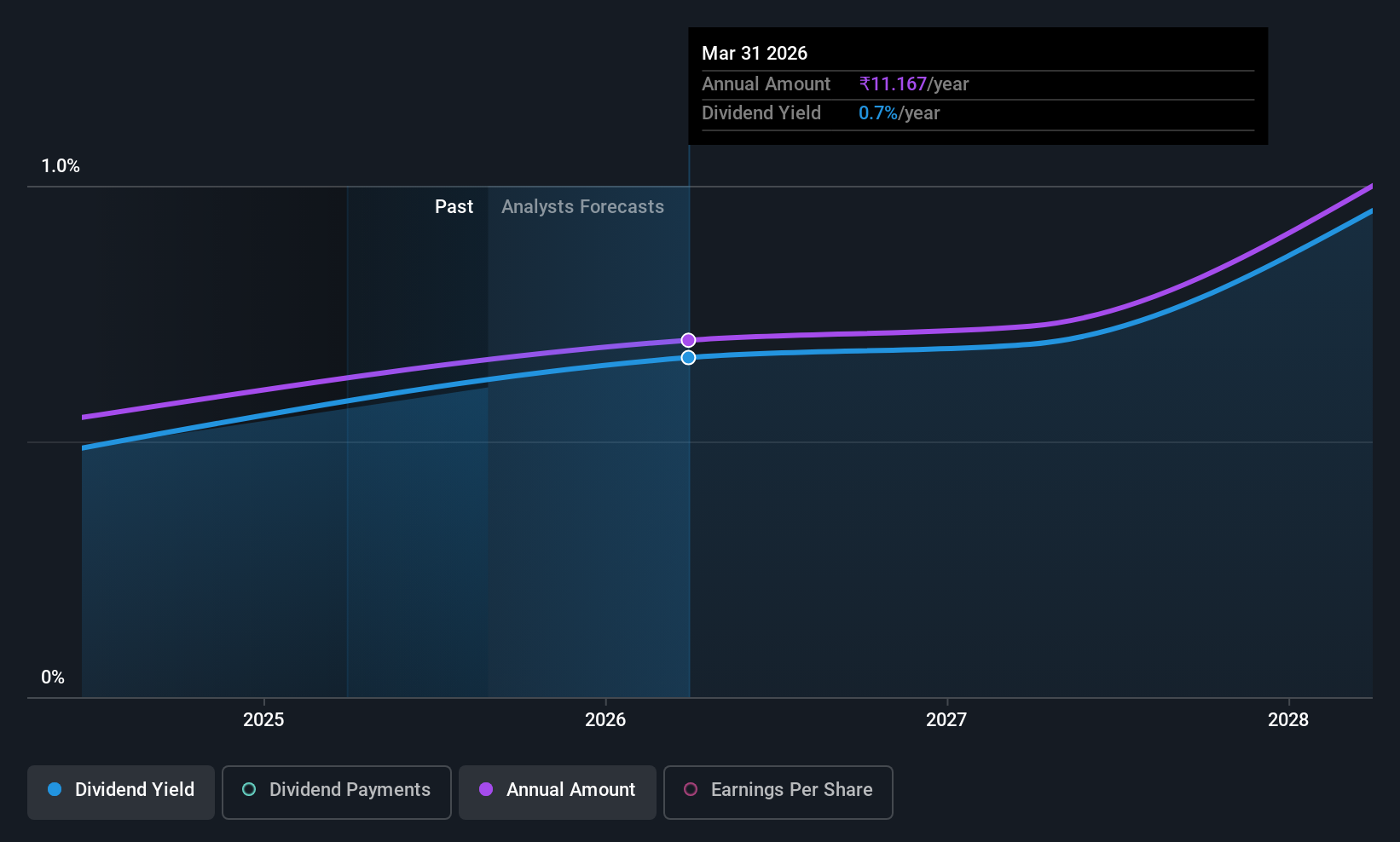

The company's next dividend payment will be ₹10.70 per share. Last year, in total, the company distributed ₹10.70 to shareholders. Based on the last year's worth of payments, Concord Biotech has a trailing yield of 0.6% on the current stock price of ₹1681.70. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Concord Biotech paid out a comfortable 30% of its profit last year. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Dividends consumed 69% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's positive to see that Concord Biotech's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Concord Biotech

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Fortunately for readers, Concord Biotech's earnings per share have been growing at 16% a year for the past five years. Concord Biotech is paying out a bit over half its earnings, which suggests the company is striking a balance between reinvesting in growth, and paying dividends. This is a reasonable combination that could hint at some further dividend increases in the future.

Unfortunately Concord Biotech has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

The Bottom Line

Is Concord Biotech worth buying for its dividend? Earnings per share have grown at a nice rate in recent times and over the last year, Concord Biotech paid out less than half its earnings and a bit over half its free cash flow. Overall we think this is an attractive combination and worthy of further research.

Wondering what the future holds for Concord Biotech? See what the five analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CONCORDBIO

Concord Biotech

A biopharma company, engages in the research and development, manufacture, market, and sale of pharmaceutical products in India and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion