Market Participants Recognise Cohance Lifesciences Limited's (NSE:COHANCE) Revenues

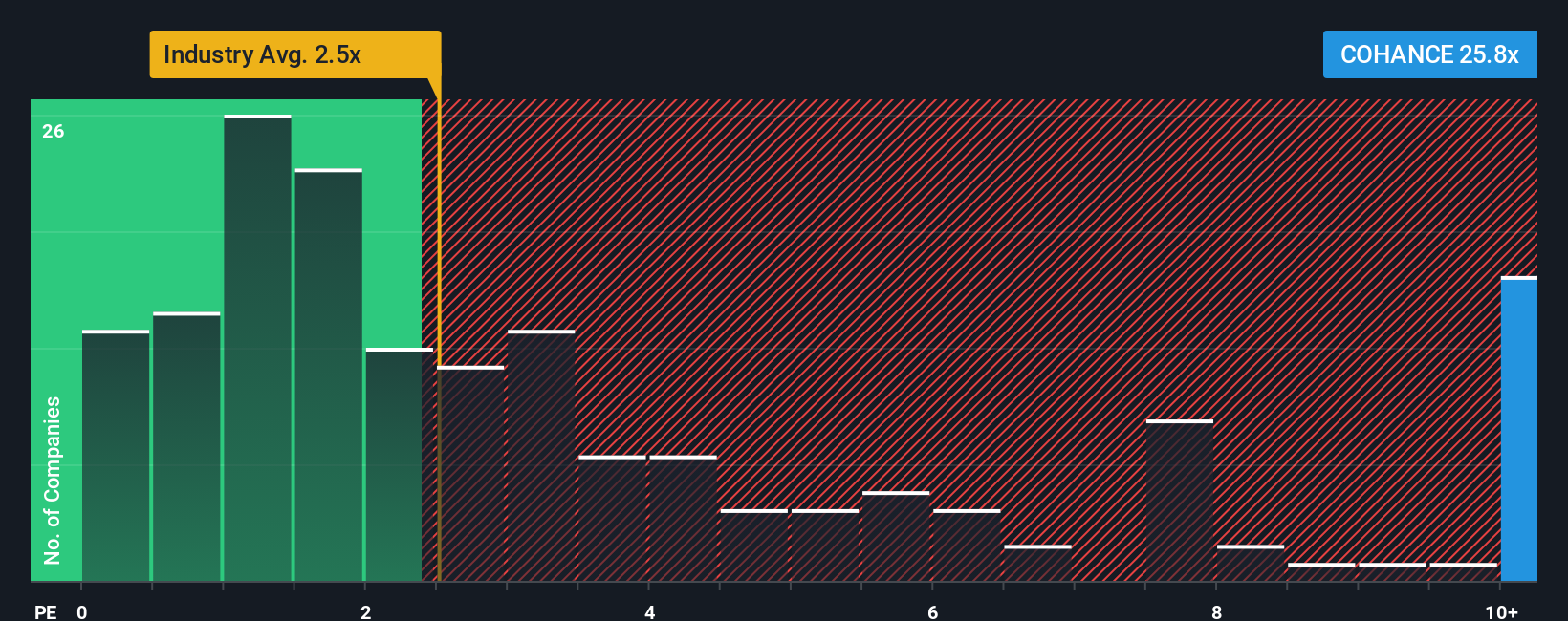

Cohance Lifesciences Limited's (NSE:COHANCE) price-to-sales (or "P/S") ratio of 25.8x may look like a poor investment opportunity when you consider close to half the companies in the Pharmaceuticals industry in India have P/S ratios below 2.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Cohance Lifesciences

What Does Cohance Lifesciences' Recent Performance Look Like?

Recent times have been advantageous for Cohance Lifesciences as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Cohance Lifesciences will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Cohance Lifesciences would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 9.8% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 152% over the next year. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Cohance Lifesciences' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Cohance Lifesciences shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Cohance Lifesciences, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COHANCE

Cohance Lifesciences

Engages in the contract research, development, and manufacturing of new chemical entity (NCE) based intermediates, active pharmaceutical ingredients (API), specialty chemicals, and formulated drugs in India, the United States, Europe, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives