Caplin Point Laboratories (NSE:CAPPL) Shareholders Have Enjoyed A Whopping 563% Share Price Gain

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. For example, the Caplin Point Laboratories Limited (NSE:CAPPL) share price is up a whopping 563% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. Meanwhile the share price is 1.5% higher than it was a week ago.

It really delights us to see such great share price performance for investors.

View our latest analysis for Caplin Point Laboratories

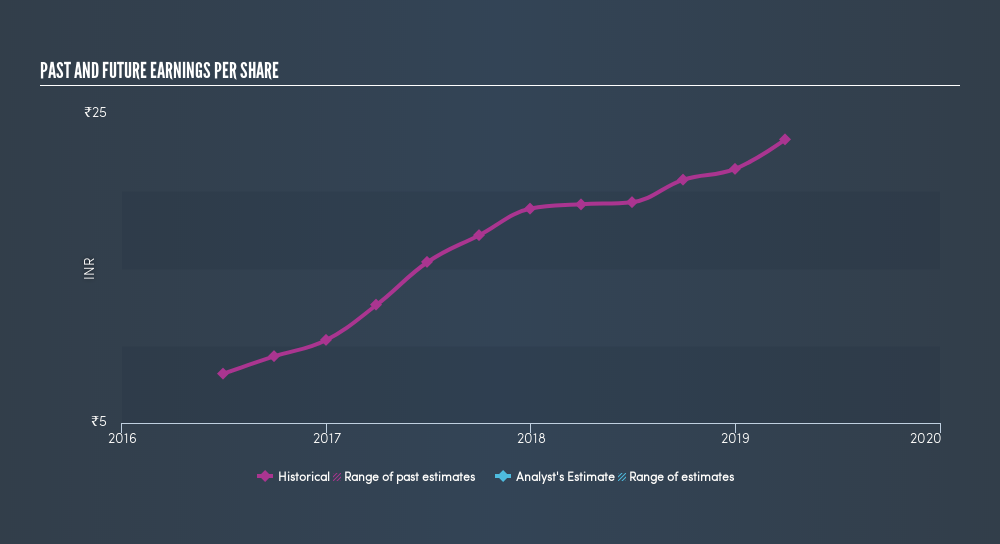

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Caplin Point Laboratories managed to grow its earnings per share at 54% a year. So the EPS growth rate is rather close to the annualized share price gain of 46% per year. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Caplin Point Laboratories's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Caplin Point Laboratories the TSR over the last 5 years was 580%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Caplin Point Laboratories shareholders have received a total shareholder return of 8.0% over the last year. And that does include the dividend. However, that falls short of the 47% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. If you would like to research Caplin Point Laboratories in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:CAPLIPOINT

Caplin Point Laboratories

Engages in the development, production, marketing, and export of generic pharmaceutical formulations and branded products in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives