AstraZeneca Pharma India Limited's (NSE:ASTRAZEN) 28% Jump Shows Its Popularity With Investors

AstraZeneca Pharma India Limited (NSE:ASTRAZEN) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 62%.

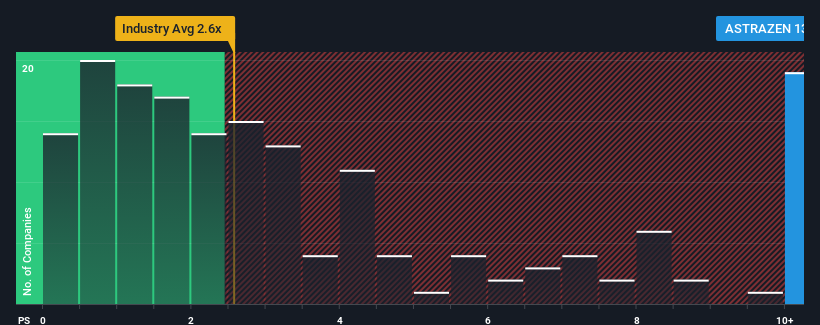

After such a large jump in price, given around half the companies in India's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider AstraZeneca Pharma India as a stock to avoid entirely with its 13.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for AstraZeneca Pharma India

How AstraZeneca Pharma India Has Been Performing

Recent times have been quite advantageous for AstraZeneca Pharma India as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on AstraZeneca Pharma India will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

AstraZeneca Pharma India's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why AstraZeneca Pharma India is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From AstraZeneca Pharma India's P/S?

AstraZeneca Pharma India's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of AstraZeneca Pharma India revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

And what about other risks? Every company has them, and we've spotted 2 warning signs for AstraZeneca Pharma India you should know about.

If you're unsure about the strength of AstraZeneca Pharma India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASTRAZEN

AstraZeneca Pharma India

A biopharmaceutical company, engages in manufacturing, distributing, and marketing of pharmaceutical products in India and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives