The Market Doesn't Like What It Sees From T.V. Today Network Limited's (NSE:TVTODAY) Earnings Yet

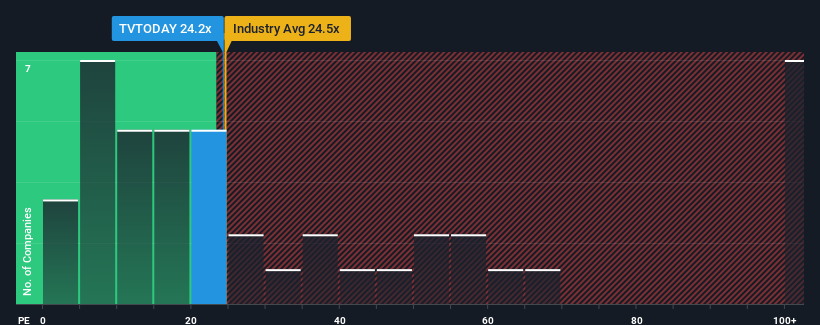

With a price-to-earnings (or "P/E") ratio of 24.2x T.V. Today Network Limited (NSE:TVTODAY) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 28x and even P/E's higher than 53x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, T.V. Today Network's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for T.V. Today Network

Is There Any Growth For T.V. Today Network?

There's an inherent assumption that a company should underperform the market for P/E ratios like T.V. Today Network's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 57%. As a result, earnings from three years ago have also fallen 59% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

In light of this, it's understandable that T.V. Today Network's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of T.V. Today Network revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with T.V. Today Network (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on T.V. Today Network, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if T.V. Today Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TVTODAY

T.V. Today Network

Engages in the broadcasting of television news channels and other media operations in India, the United States, Ireland, the United Kingdom, Canada, the United Arab Emirates, Qatar, South Africa, Maldives, and Seychelles.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives