Exploring Coforge And Two Other High Growth Tech Stocks In India

Reviewed by Simply Wall St

The Indian market has remained flat over the past week but has shown a remarkable 45% rise over the last year, with earnings projected to grow by 17% annually. In this context, identifying high-growth tech stocks like Coforge and others becomes crucial as they have the potential to capitalize on these favorable conditions and deliver robust performance.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.11% | 42.50% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

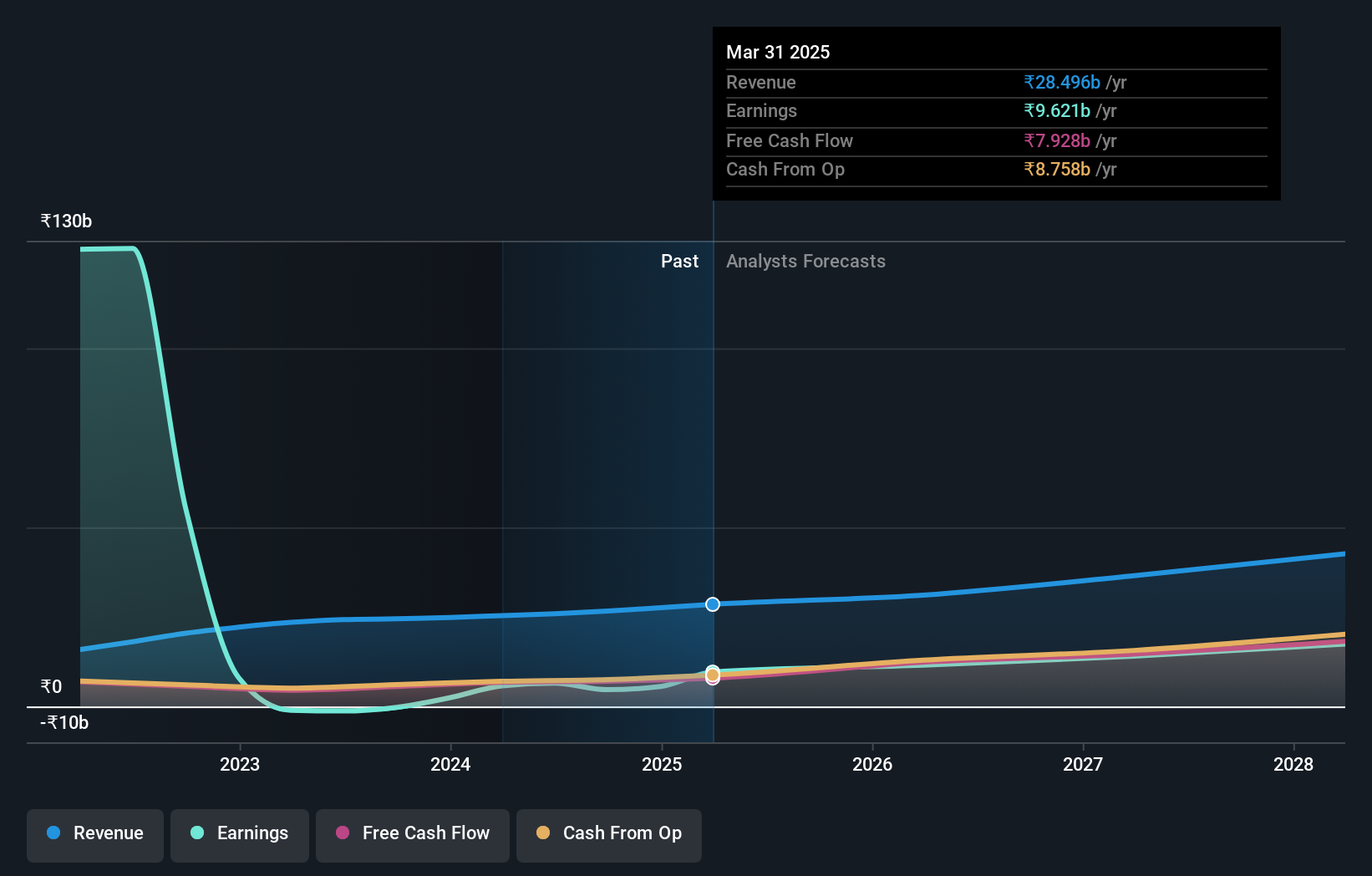

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coforge Limited offers IT and IT-enabled services across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific with a market cap of ₹470.87 billion.

Operations: The company generates revenue primarily from its Software Solutions segment, amounting to ₹93.59 billion.

Coforge's strategic initiatives, particularly its collaboration with Salesforce to launch the Coforge ENZO platform, underscore its commitment to integrating advanced AI solutions in environmental and sustainability efforts. This move not only enhances its service offerings but also positions it favorably within the tech sector focused on ESG (Environmental, Social, and Governance) trends. Financially, Coforge is poised for robust growth with a revenue increase projected at 15.3% annually and earnings expected to surge by 23.1% per year. These figures reflect a dynamic adaptation to market demands and an aggressive pursuit of innovation through R&D investments which are crucial for maintaining competitive edge in the rapidly evolving tech landscape of India.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited is an online classifieds company focusing on recruitment, matrimony, real estate, and education services in India and internationally, with a market cap of ₹1.05 trillion.

Operations: The company generates revenue primarily from recruitment solutions and real estate services, with recruitment solutions contributing significantly more than real estate. The net profit margin shows a notable trend at 23%, indicating efficient cost management relative to income.

Info Edge (India) has demonstrated a robust financial trajectory with a notable 13% annual revenue growth, outpacing the broader Indian market's expansion rate of 10.1%. This growth is complemented by an impressive forecasted earnings increase of 23.6% per year, signaling strong operational efficiency and market demand for its services. The company's strategic investment in Nexstem India Private Limited, as decided in their recent board meeting, aligns with its commitment to enhancing technological capabilities and expanding its portfolio. Moreover, the appointment of industry veterans like Mr. Hoonar Janu underscores Info Edge’s focus on strengthening leadership in policy strategy and digital transformation initiatives critical for sustaining long-term growth in the competitive tech landscape of India.

- Get an in-depth perspective on Info Edge (India)'s performance by reading our health report here.

Evaluate Info Edge (India)'s historical performance by accessing our past performance report.

Tips Music (NSEI:TIPSMUSIC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Tips Music Limited is involved in the acquisition and exploitation of music rights both in India and internationally, with a market capitalization of ₹93.42 billion.

Operations: The company generates revenue primarily from its music segment, which includes audio and video content, amounting to ₹2.63 billion.

Tips Music, a player in the Indian entertainment industry, has showcased impressive growth metrics that align with the high-growth trajectory of tech-oriented markets. With revenue and earnings forecasted to grow annually by 24.7% and 24.2% respectively, Tips Music outpaces the broader market's expansion rates significantly. This growth is further underscored by a robust past year earnings increase of 66.2%, doubling the industry average of 31.6%. Recent engagements at key conferences and consistent shareholder communications reflect an active pursuit of market share and investor confidence amidst competitive dynamics. The company's strategic maneuvers, including its recent name change and dividend policies, signal a forward-looking approach to capital management and brand positioning in a vibrant digital media space.

- Take a closer look at Tips Music's potential here in our health report.

Gain insights into Tips Music's historical performance by reviewing our past performance report.

Seize The Opportunity

- Access the full spectrum of 38 Indian High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:COFORGE

Coforge

Provides information technology (IT) and IT-enabled services in India, the Americas, Europe, the Middle East and Africa, India, and the Asia Pacific.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives