- India

- /

- Entertainment

- /

- NSEI:SHEMAROO

Market Cool On Shemaroo Entertainment Limited's (NSE:SHEMAROO) Revenues Pushing Shares 30% Lower

Shemaroo Entertainment Limited (NSE:SHEMAROO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 34% in the last year.

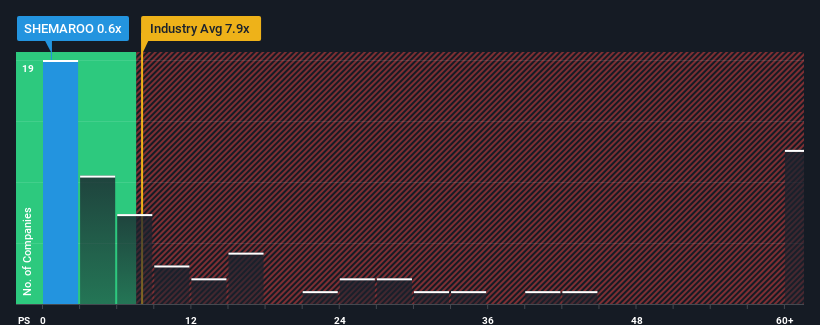

Following the heavy fall in price, Shemaroo Entertainment's price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the wider Entertainment industry in India, where around half of the companies have P/S ratios above 7.9x and even P/S above 29x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Shemaroo Entertainment

What Does Shemaroo Entertainment's Recent Performance Look Like?

Shemaroo Entertainment certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shemaroo Entertainment will help you shine a light on its historical performance.How Is Shemaroo Entertainment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Shemaroo Entertainment's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. The strong recent performance means it was also able to grow revenue by 89% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 15%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Shemaroo Entertainment's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shemaroo Entertainment's P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shemaroo Entertainment revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Shemaroo Entertainment (3 make us uncomfortable!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Shemaroo Entertainment, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHEMAROO

Shemaroo Entertainment

Engages in the distribution of content for broadcasting of satellite channels, physical formats and digital technologies in India.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026