The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Sandesh (NSE:SANDESH), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Sandesh

Sandesh's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Sandesh grew its EPS by 8.9% per year. That growth rate is fairly good, assuming the company can keep it up.

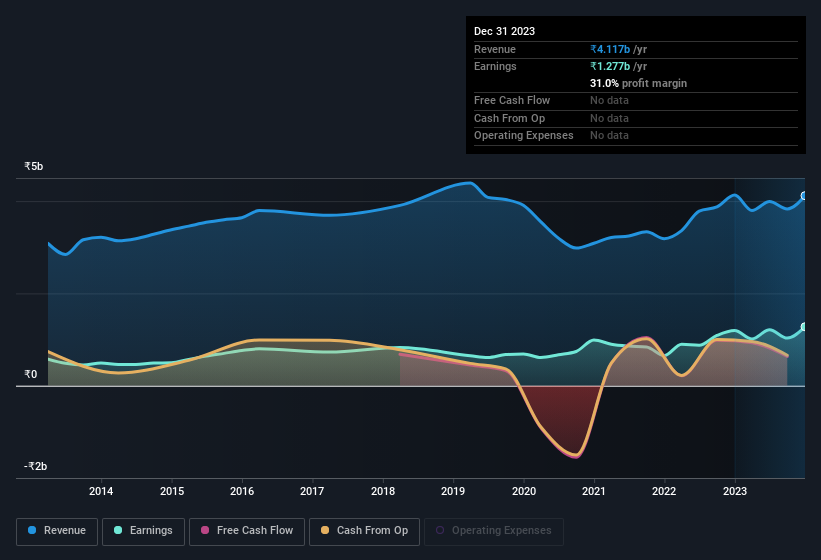

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Sandesh's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. This approach makes Sandesh look pretty good, on balance; although revenue is flattish, EBIT margins improved from 33% to 39% in the last year. That's something to smile about.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Sandesh isn't a huge company, given its market capitalisation of ₹8.4b. That makes it extra important to check on its balance sheet strength.

Are Sandesh Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Sandesh followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at ₹2.2b. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 27% of the company; visible skin in the game.

Is Sandesh Worth Keeping An Eye On?

One important encouraging feature of Sandesh is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. Of course, just because Sandesh is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SANDESH

Sandesh

Together with its subsidiary, Sandesh Digital Private Limited, engages in the editing, printing, and publishing of newspapers and periodicals in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026