- India

- /

- Entertainment

- /

- NSEI:PFOCUS

The Market Lifts Prime Focus Limited (NSE:PFOCUS) Shares 29% But It Can Do More

Despite an already strong run, Prime Focus Limited (NSE:PFOCUS) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 95% in the last year.

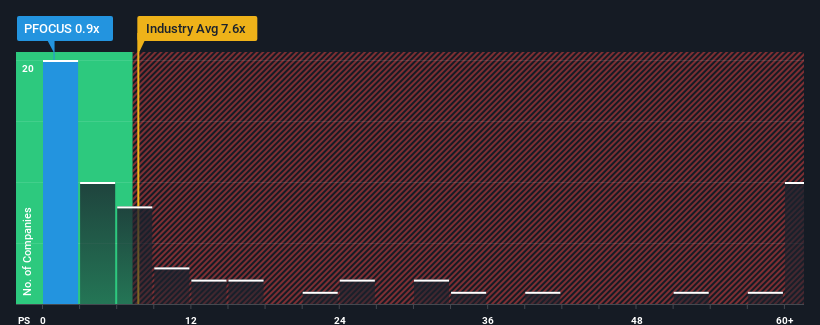

Although its price has surged higher, Prime Focus may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Entertainment industry in India have P/S ratios greater than 7.6x and even P/S higher than 34x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Prime Focus

How Has Prime Focus Performed Recently?

The revenue growth achieved at Prime Focus over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Prime Focus, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Prime Focus' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Prime Focus' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 68% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Prime Focus' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Prime Focus' P/S?

Shares in Prime Focus have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Prime Focus currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Having said that, be aware Prime Focus is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PFOCUS

Prime Focus

Provides integrated media services primarily in India, the United Kingdom, the United States, Canada, Australia, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives