Nxtdigital (NSE:NXTDIGITAL) Will Pay A Smaller Dividend Than Last Year

Nxtdigital Limited (NSE:NXTDIGITAL) is reducing its dividend to ₹4.00 on the 28th of October. This means that the dividend yield is 0.8%, which is a bit low when comparing to other companies in the industry.

See our latest analysis for Nxtdigital

Nxtdigital's Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. Nxtdigital is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS could expand by 21.7% if recent trends continue. It's nice to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Dividend Volatility

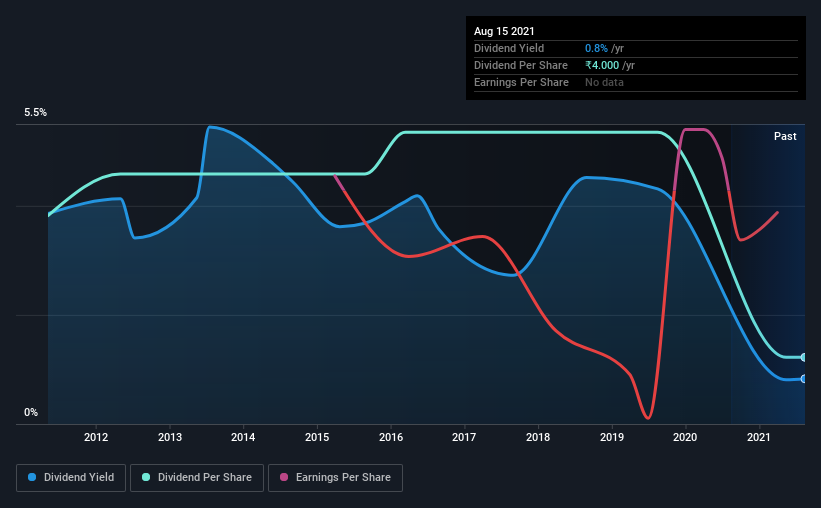

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from ₹12.50 in 2011 to the most recent annual payment of ₹4.00. Dividend payments have fallen sharply, down 68% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. We are encouraged to see that Nxtdigital has grown earnings per share at 22% per year over the past five years. While the company is not yet turning a profit, it is growing at a good rate. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward.

We'd also point out that Nxtdigital has issued stock equal to 17% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for Nxtdigital that investors should know about before committing capital to this stock. We have also put together a list of global stocks with a solid dividend.

When trading Nxtdigital or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NDL Ventures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NDLVENTURE

NDL Ventures

Through its subsidiaries, engages in real estate business in India.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026