We Think Network18 Media & Investments' (NSE:NETWORK18) Solid Earnings Are Understated

Investors signalled that they were pleased with Network18 Media & Investments Limited's (NSE:NETWORK18) most recent earnings report, with a strong stock price reaction. According to our analysis of the report, the strong headline profit numbers are supported by strong earnings fundamentals.

See our latest analysis for Network18 Media & Investments

A Closer Look At Network18 Media & Investments' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

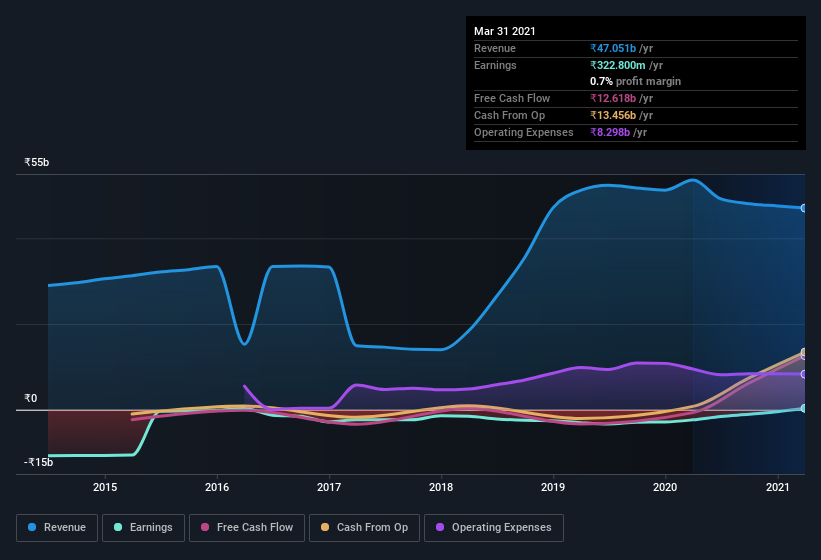

For the year to March 2021, Network18 Media & Investments had an accrual ratio of -0.21. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of ₹13b in the last year, which was a lot more than its statutory profit of ₹322.8m. Notably, Network18 Media & Investments had negative free cash flow last year, so the ₹13b it produced this year was a welcome improvement.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Network18 Media & Investments.

Our Take On Network18 Media & Investments' Profit Performance

As we discussed above, Network18 Media & Investments' accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Based on this observation, we consider it possible that Network18 Media & Investments' statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Network18 Media & Investments as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Network18 Media & Investments you should know about.

Today we've zoomed in on a single data point to better understand the nature of Network18 Media & Investments' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Network18 Media & Investments or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Network18 Media & Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NETWORK18

Network18 Media & Investments

Engages in broadcasting, digital content, print, and allied businesses in India.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives