- India

- /

- Entertainment

- /

- NSEI:NAZARA

The Market Lifts Nazara Technologies Limited (NSE:NAZARA) Shares 27% But It Can Do More

Nazara Technologies Limited (NSE:NAZARA) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

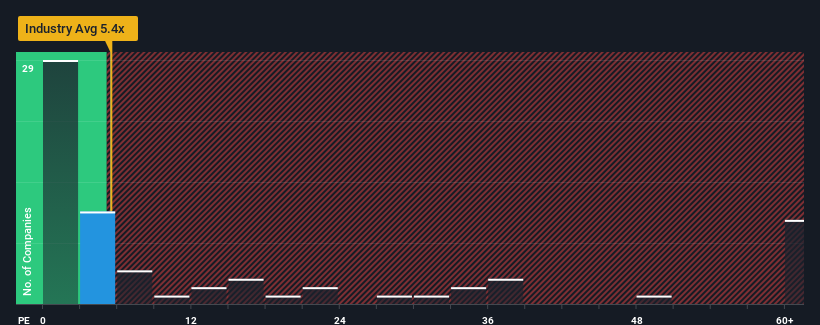

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Nazara Technologies' P/S ratio of 5.4x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in India is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Nazara Technologies

What Does Nazara Technologies' Recent Performance Look Like?

Recent times haven't been great for Nazara Technologies as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Nazara Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Nazara Technologies?

In order to justify its P/S ratio, Nazara Technologies would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.3% last year. Pleasingly, revenue has also lifted 151% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 18% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 7.6% each year, which is noticeably less attractive.

With this information, we find it interesting that Nazara Technologies is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Nazara Technologies appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Nazara Technologies' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Nazara Technologies you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nazara Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NAZARA

Nazara Technologies

Operates a gaming and sports media platform in India, Africa, the Middle East, the Asia Pacific, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.