- India

- /

- Entertainment

- /

- NSEI:PVRINOX

High Growth Tech Stocks In India Featuring Coforge And Two Others

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.0%, but it has seen a robust increase of 39% over the past year, with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying high-growth tech stocks like Coforge and others can be key to capitalizing on future opportunities.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Syrma SGS Technology | 21.85% | 31.90% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.12% | 41.74% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coforge Limited offers IT and IT enabled services across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific, with a market cap of ₹432.89 billion.

Operations: Coforge Limited generates revenue primarily from its Software Solutions segment, which contributed ₹93.59 billion. The company operates across multiple regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Coforge's revenue is forecasted to grow at 14.5% per year, outpacing the Indian market's 10.1% growth rate, but still slower than the desired 20%. The company's earnings are expected to surge by 22.6% annually over the next three years, highlighting significant potential in its AI and software segments. Recently teaming up with Salesforce on an environmental initiative enhances its sustainability credentials and broadens its client base. With R&D expenses reflecting a commitment to innovation, Coforge’s strategic moves could position it well for future growth despite recent shareholder dilution.

- Unlock comprehensive insights into our analysis of Coforge stock in this health report.

Evaluate Coforge's historical performance by accessing our past performance report.

Nazara Technologies (NSEI:NAZARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nazara Technologies Limited operates a gaming and sports media platform in India and internationally, with a market cap of ₹70.74 billion.

Operations: Nazara Technologies generates revenue primarily from three segments: Gaming (₹3.90 billion), E-Sports (₹6.46 billion), and AD Tech Business (₹1.02 billion). The company's business model focuses on leveraging its gaming and sports media platform across these key areas to drive growth and engagement both in India and internationally.

Nazara Technologies, a prominent player in India's gaming and sports media sector, has shown robust earnings growth of 50% over the past year, outpacing the entertainment industry's 33.8%. With R&D expenses reflecting a strong commitment to innovation, Nazara's revenue is forecasted to grow at 17.7% per year while earnings are expected to increase by 24.4% annually over the next three years. The company's recent strategic moves include tuck-in acquisitions and expanding its footprint with new subsidiaries in the UK and US, positioning it for sustained growth in a competitive market.

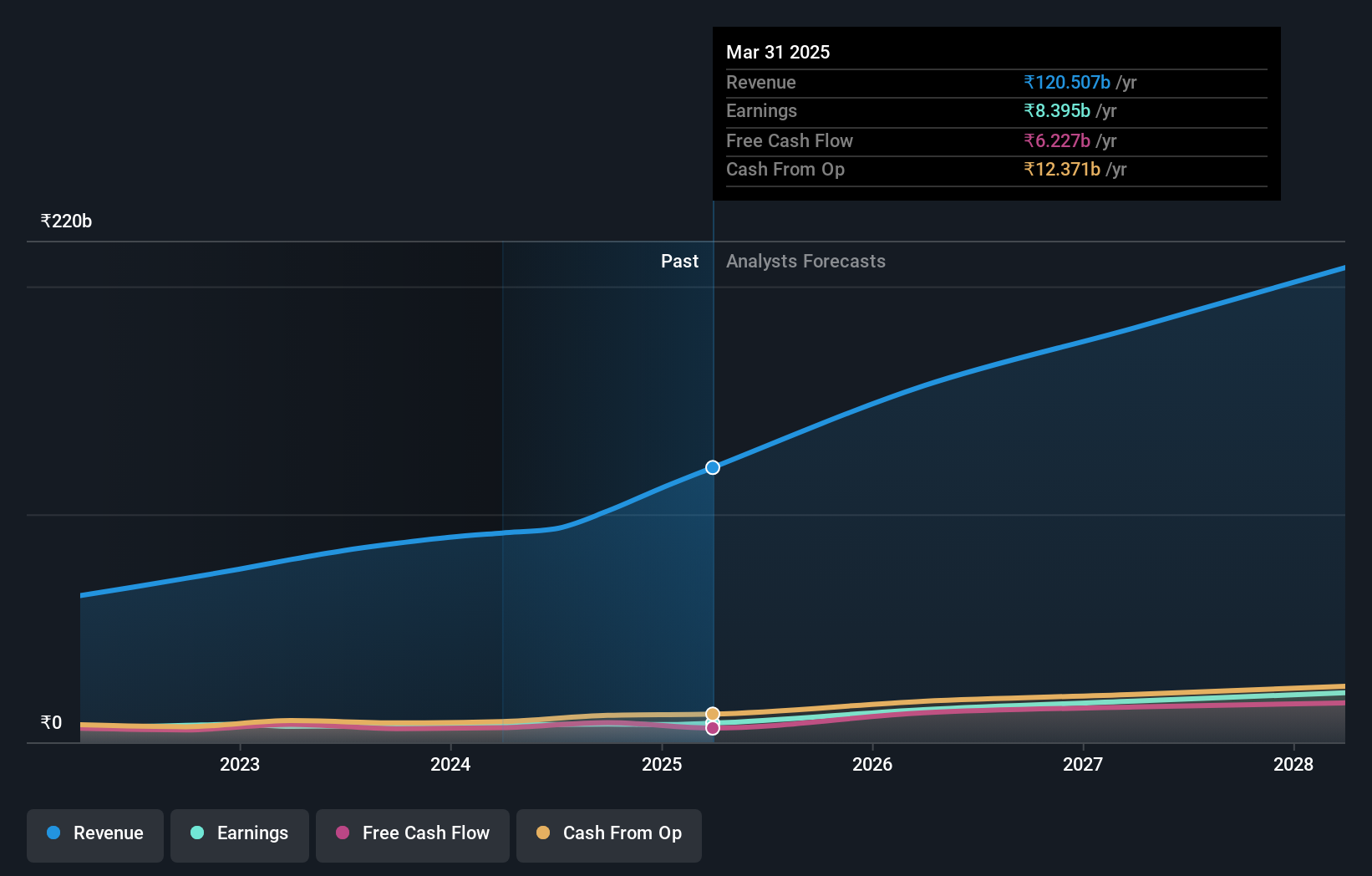

PVR INOX (NSEI:PVRINOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited is a theatrical exhibition company involved in the exhibition, distribution, and production of movies in India and Sri Lanka with a market cap of ₹153.72 billion.

Operations: The company's primary revenue stream is derived from movie exhibition, generating ₹59.48 billion. Additionally, it engages in the distribution and production of movies across India and Sri Lanka.

PVR INOX has been expanding aggressively, with recent openings like the 9-screen multiplex at Phoenix Palladium Mall in Ahmedabad and a 4-screen cinema in Hyderabad. Despite reporting a net loss of ₹1.79 billion for Q1 2024, the company's revenue is projected to grow by 12.1% annually, outpacing the Indian market's 10.1%. Forecasts indicate earnings growth of 60.6% per year, reflecting strong future potential despite current unprofitability and significant R&D investment aimed at enhancing customer experience through advanced cinematic technologies like IMAX® with Laser and Dolby ATMOS sound systems.

- Click here and access our complete health analysis report to understand the dynamics of PVR INOX.

Understand PVR INOX's track record by examining our Past report.

Taking Advantage

- Reveal the 38 hidden gems among our Indian High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PVRINOX

PVR INOX

A theatrical exhibition company, engages in the exhibition, distribution, and production of movies in India and Sri Lanka.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.