- India

- /

- Entertainment

- /

- NSEI:NAZARA

3 Indian Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The Indian market has remained flat over the past week but has experienced a significant 40% increase over the last year, with earnings projected to grow by 17% annually in the coming years. In this context, identifying growth stocks with high insider ownership can be appealing as it often indicates confidence from those closest to the company and aligns well with anticipated market expansion.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.4% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

| KEI Industries (BSE:517569) | 19.2% | 21.9% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Here's a peek at a few of the choices from the screener.

Greenpanel Industries (NSEI:GREENPANEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greenpanel Industries Limited is involved in the manufacturing, marketing, and sale of plywood, medium density fibre board (MDF), and related products both in India and internationally, with a market cap of ₹48.92 billion.

Operations: The company's revenue is primarily derived from Medium Density Fibre Boards and Allied Products, amounting to ₹14.05 billion, and Plywood and Allied Products, contributing ₹1.62 billion.

Insider Ownership: 13.6%

Revenue Growth Forecast: 14.6% p.a.

Greenpanel Industries demonstrates strong growth potential with forecasted earnings growth of 25.6% per year, outpacing the Indian market's 17.3%. Despite this, profit margins have decreased from last year, and its dividend yield is not well covered by free cash flows. The company's revenue growth of 14.6% annually surpasses the market average but remains below a high-growth threshold of 20%. There has been no substantial insider trading activity in recent months.

- Click to explore a detailed breakdown of our findings in Greenpanel Industries' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Greenpanel Industries shares in the market.

HealthCare Global Enterprises (NSEI:HCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HealthCare Global Enterprises Limited, along with its subsidiaries, offers medical and healthcare services specializing in cancer and fertility both in India and internationally, with a market cap of ₹62.62 billion.

Operations: The company generates revenue primarily from setting up and managing hospitals and medical diagnostic services, amounting to ₹19.77 billion.

Insider Ownership: 13.8%

Revenue Growth Forecast: 13.5% p.a.

HealthCare Global Enterprises is poised for significant growth, with earnings anticipated to increase by 42.8% annually, outstripping the Indian market's average. Revenue is also expected to grow at 13.5% per year, though below a high-growth benchmark. Despite low forecasted return on equity and interest payments not being well-covered by earnings, insider trading has seen more buying than selling recently. The company is actively exploring inorganic growth opportunities through potential acquisitions or investments.

- Click here to discover the nuances of HealthCare Global Enterprises with our detailed analytical future growth report.

- Our expertly prepared valuation report HealthCare Global Enterprises implies its share price may be too high.

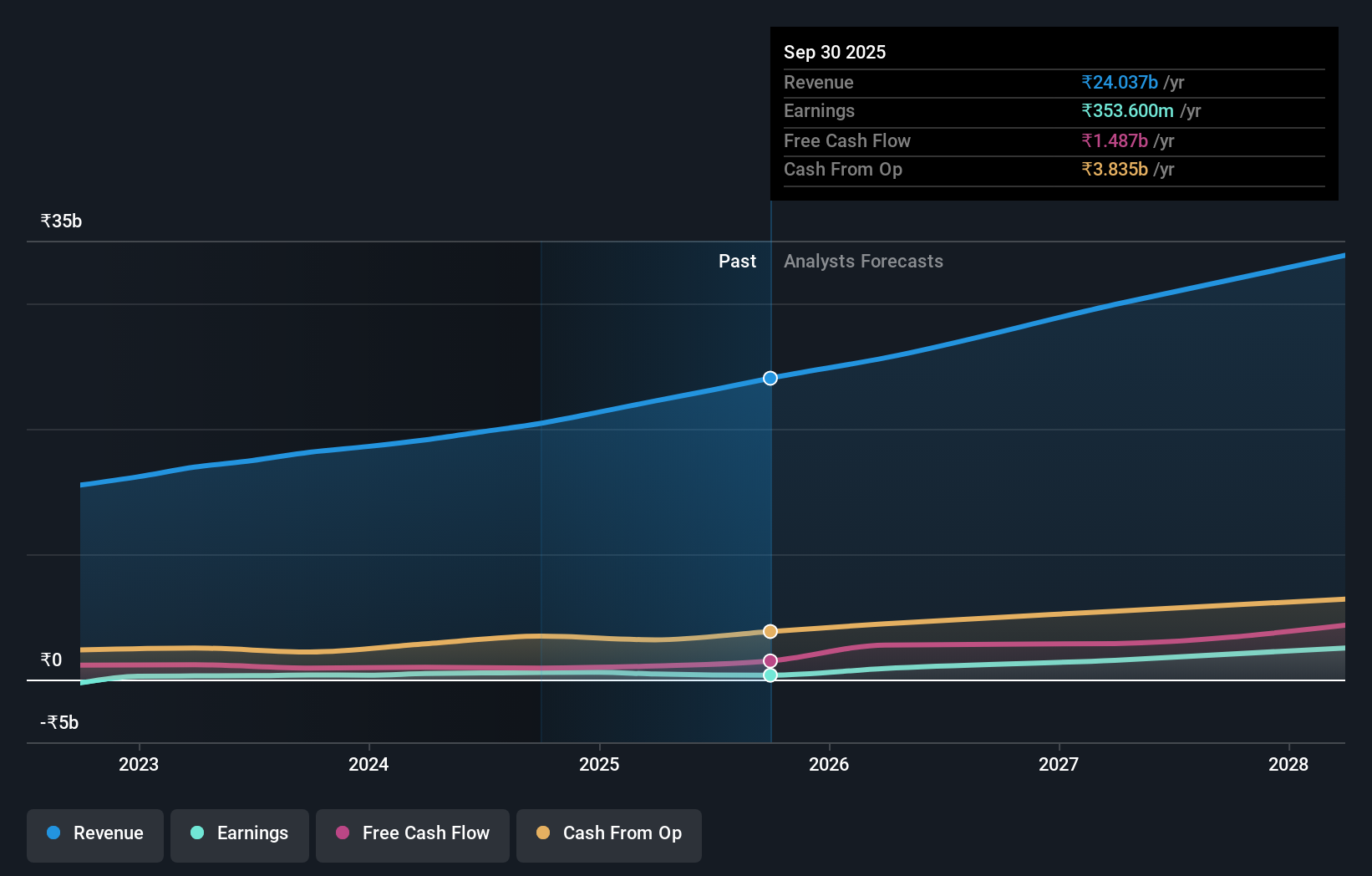

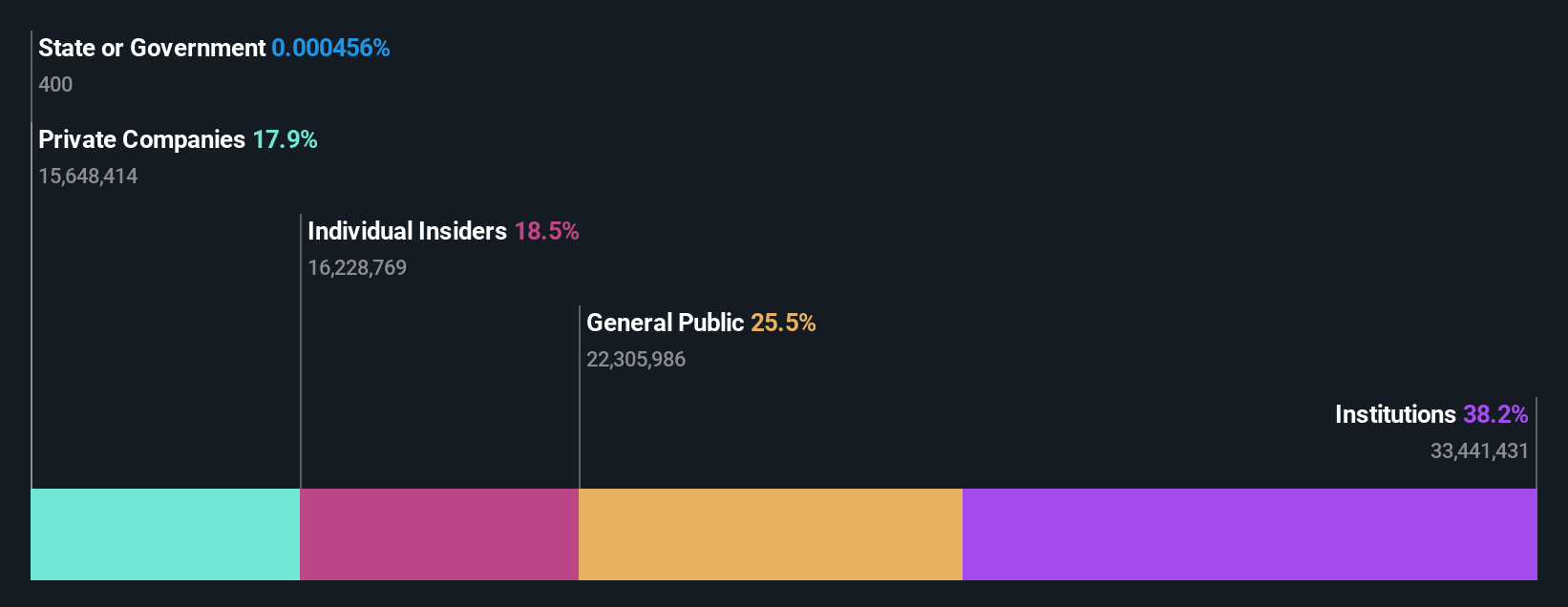

Nazara Technologies (NSEI:NAZARA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nazara Technologies Limited operates a gaming and sports media platform across India, Africa, the Middle East, the Asia Pacific, the United States, and other international markets with a market cap of ₹70.68 billion.

Operations: The company's revenue is derived from its segments: Gaming at ₹3.90 billion, E-Sports at ₹6.46 billion, and AD Tech Business at ₹1.02 billion.

Insider Ownership: 22.3%

Revenue Growth Forecast: 17.9% p.a.

Nazara Technologies is experiencing significant growth, with earnings projected to rise by 24.9% annually, surpassing the Indian market average. Revenue is expected to grow at 17.9% per year, faster than the market's 10.2%. Recent board changes include appointing Vivek Chopra as a director and a new auditor firm, M S K C & Associates. Despite past shareholder dilution and low forecasted return on equity of 7.1%, Nazara continues strategic expansions and private placements for future growth initiatives.

- Unlock comprehensive insights into our analysis of Nazara Technologies stock in this growth report.

- Our valuation report unveils the possibility Nazara Technologies' shares may be trading at a premium.

Seize The Opportunity

- Gain an insight into the universe of 90 Fast Growing Indian Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nazara Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NAZARA

Nazara Technologies

Operates a gaming and sports media platform in India, Africa, the Middle East, the Asia Pacific, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026