- India

- /

- Interactive Media and Services

- /

- NSEI:MATRIMONY

Matrimony.com Limited's (NSE:MATRIMONY) Shares Climb 27% But Its Business Is Yet to Catch Up

Matrimony.com Limited (NSE:MATRIMONY) shares have continued their recent momentum with a 27% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

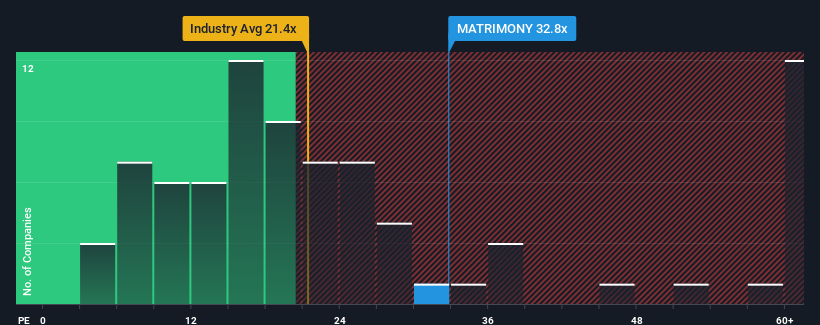

Even after such a large jump in price, there still wouldn't be many who think Matrimony.com's price-to-earnings (or "P/E") ratio of 32.8x is worth a mention when the median P/E in India is similar at about 32x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's inferior to most other companies of late, Matrimony.com has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Matrimony.com

Is There Some Growth For Matrimony.com?

The only time you'd be comfortable seeing a P/E like Matrimony.com's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Fortunately, a few good years before that means that it was still able to grow EPS by 12% in total over the last three years. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 14% per annum during the coming three years according to the one analyst following the company. Meanwhile, the rest of the market is forecast to expand by 20% per annum, which is noticeably more attractive.

In light of this, it's curious that Matrimony.com's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Matrimony.com's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Matrimony.com currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Matrimony.com that you should be aware of.

If these risks are making you reconsider your opinion on Matrimony.com, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MATRIMONY

Matrimony.com

A consumer internet company, provides online matchmaking services on internet and mobile platforms in India and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026