- India

- /

- Entertainment

- /

- NSEI:EROSMEDIA

Positive Sentiment Still Eludes Eros International Media Limited (NSE:EROSMEDIA) Following 25% Share Price Slump

Eros International Media Limited (NSE:EROSMEDIA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

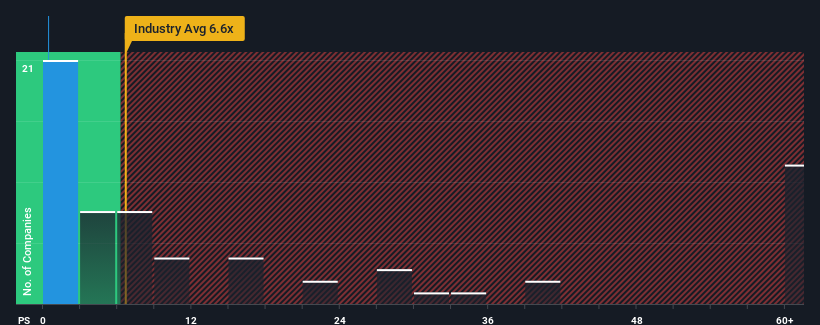

Since its price has dipped substantially, Eros International Media may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Entertainment industry in India have P/S ratios greater than 6.6x and even P/S higher than 28x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Eros International Media

What Does Eros International Media's P/S Mean For Shareholders?

Eros International Media certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eros International Media's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Eros International Media's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 43%. The strong recent performance means it was also able to grow revenue by 55% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 14% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that Eros International Media's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Eros International Media's P/S?

Shares in Eros International Media have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Eros International Media currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Eros International Media you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Eros International Media, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eros International Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EROSMEDIA

Eros International Media

Engages in the production, exploitation, and distribution of films in India, the United Arab Emirates, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives