- India

- /

- Entertainment

- /

- NSEI:EROSMEDIA

Health Check: How Prudently Does Eros International Media (NSE:EROSMEDIA) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Eros International Media Limited (NSE:EROSMEDIA) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Eros International Media

What Is Eros International Media's Debt?

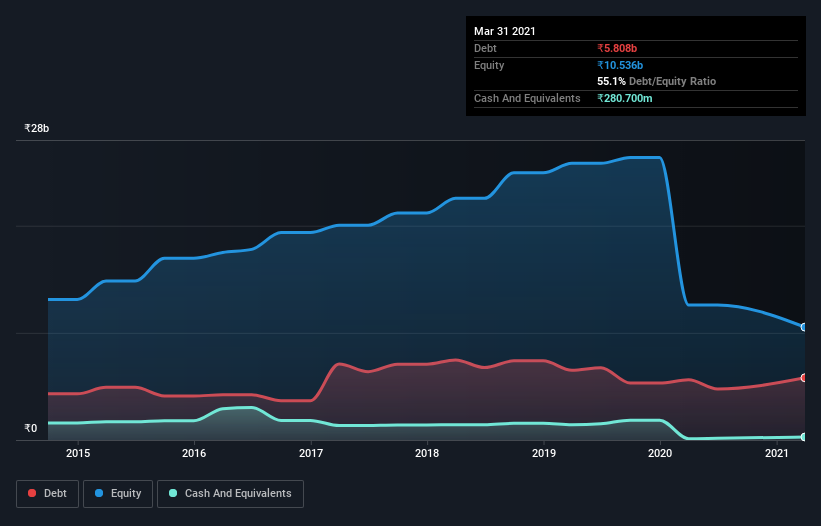

As you can see below, Eros International Media had ₹5.78b of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of ₹280.7m, its net debt is less, at about ₹5.50b.

A Look At Eros International Media's Liabilities

The latest balance sheet data shows that Eros International Media had liabilities of ₹11.3b due within a year, and liabilities of ₹2.27b falling due after that. Offsetting these obligations, it had cash of ₹280.7m as well as receivables valued at ₹5.08b due within 12 months. So it has liabilities totalling ₹8.24b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₹2.40b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Eros International Media would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Eros International Media will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Eros International Media made a loss at the EBIT level, and saw its revenue drop to ₹2.6b, which is a fall of 68%. That makes us nervous, to say the least.

Caveat Emptor

While Eros International Media's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable ₹1.7b at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it lost ₹1.8b in just last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is quite risky. We'd prefer to pass. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Eros International Media (including 1 which is a bit concerning) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Eros International Media, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eros International Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:EROSMEDIA

Eros International Media

Engages in the production, exploitation, and distribution of films in India, the United Arab Emirates, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives