- India

- /

- Entertainment

- /

- NSEI:EROSMEDIA

Auditors Have Doubts About Eros International Media (NSE:EROSMEDIA)

Unfortunately for shareholders, when Eros International Media Limited (NSE:EROSMEDIA) reported results for the period to June 2022, its auditors, Chaturvedi & Shah, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay. Even more worrying, the auditor has noted that their opinion of the accounts is qualified, which means that the company will probably have trouble with its lenders, as well as potential investors.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for Eros International Media

What Is Eros International Media's Debt?

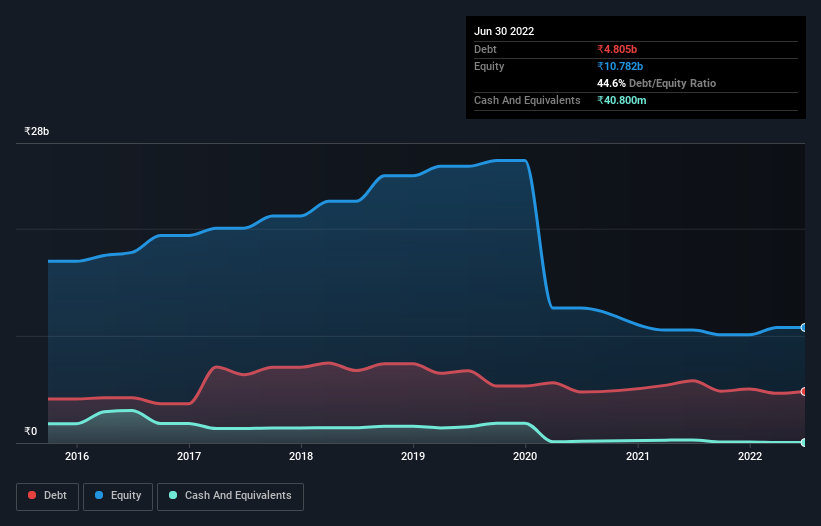

As you can see below, Eros International Media had ₹4.80b of debt at March 2022, down from ₹5.81b a year prior. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Eros International Media's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Eros International Media had liabilities of ₹10.1b due within 12 months and liabilities of ₹3.19b due beyond that. Offsetting these obligations, it had cash of ₹40.8m as well as receivables valued at ₹6.48b due within 12 months. So it has liabilities totalling ₹6.77b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₹3.87b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Eros International Media would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But it is Eros International Media's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Eros International Media wasn't profitable at an EBIT level, but managed to grow its revenue by 63%, to ₹3.9b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Eros International Media still had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping ₹403m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of ₹820m and the profit of ₹72m. So one might argue that there's still a chance it can get things on the right track. At the end of the day, recalling that the auditor has qualified their opinion of the accounts, we would strongly avoid owning this stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Eros International Media (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Eros International Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EROSMEDIA

Eros International Media

Engages in the production, exploitation, and distribution of films in India, the United Arab Emirates, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives