Stock Analysis

The Indian market has shown robust growth, rising by 44% over the past 12 months and gaining an additional 1.0% in just the last week, with earnings expected to grow by 16% annually. In such a thriving environment, dividend stocks like D B and two others stand out as potentially rewarding options for investors looking for steady income combined with the opportunity for capital appreciation.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 4.09% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 3.18% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.20% | ★★★★★☆ |

| Castrol India (BSE:500870) | 3.56% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.25% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.60% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.29% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.69% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.33% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.78% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms, with a market capitalization of approximately ₹55.20 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing segment, which brought in ₹22.43 billion, and its radio segment, which contributed ₹1.59 billion.

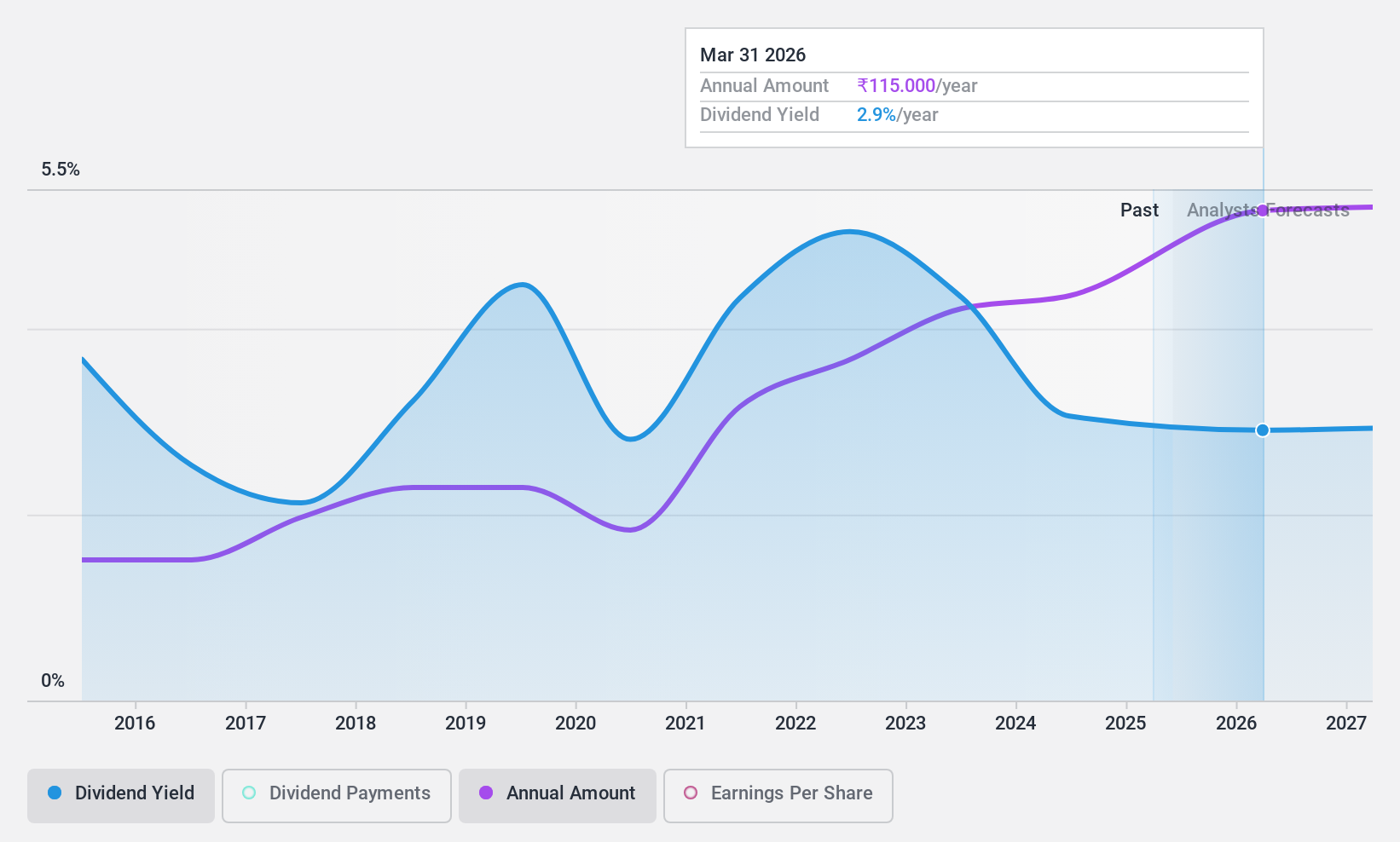

Dividend Yield: 4.2%

D. B. Corp Limited recently declared an interim dividend of INR 8 per share, reflecting a payout ratio of 54.4%, supported by a cash flow payout ratio of 43.6%. Despite its top-tier dividend yield at 4.2%, the company's dividend history has been marked by volatility over the past decade. The recent appointment of Upendra Kumar Gupta as President Finance & Accounts could herald stronger financial oversight, potentially stabilizing future payouts. This is coupled with a significant increase in net income to INR 4,255.23 million and robust sales growth, suggesting improved financial health.

- Navigate through the intricacies of D. B with our comprehensive dividend report here.

- According our valuation report, there's an indication that D. B's share price might be on the cheaper side.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors with a market capitalization of approximately ₹35.27 billion.

Operations: Swaraj Engines Limited generates its revenue primarily from the sale of diesel engines, engine components, and tractor spare parts, totaling approximately ₹14.19 billion.

Dividend Yield: 3.3%

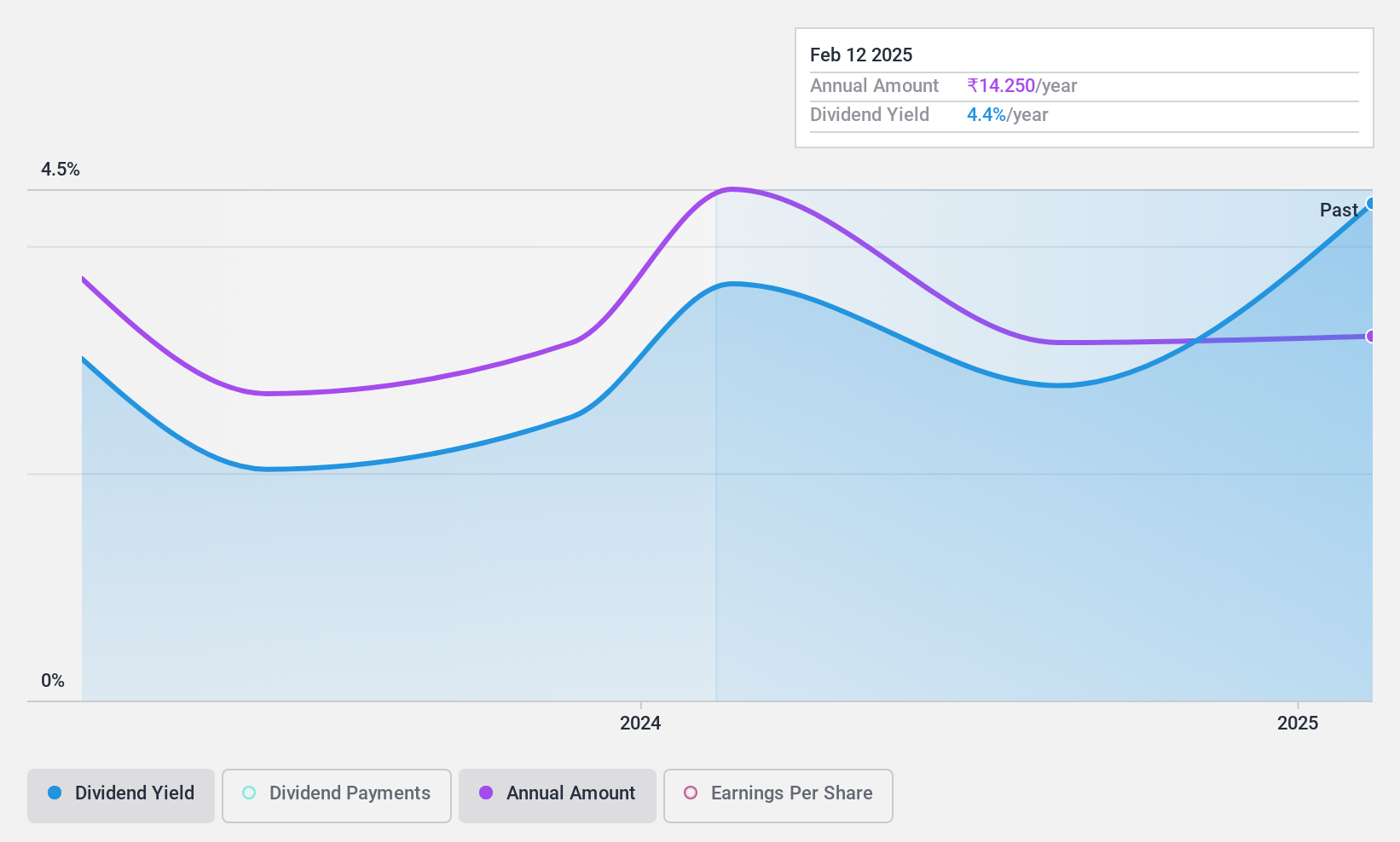

Swaraj Engines Limited has recommended a substantial dividend of INR 95 per share for FY 2024, marking a significant commitment to shareholder returns. Despite this, the company's dividend sustainability is under scrutiny with a cash payout ratio of 122%, indicating potential pressure on future payouts. Financial performance shows stability with a slight increase in annual net income to INR 1,378.7 million. However, recent regulatory challenges involving a penalty of INR 62,667 could pose minor concerns but are not expected to impact financials materially.

- Click here and access our complete dividend analysis report to understand the dynamics of Swaraj Engines.

- Our comprehensive valuation report raises the possibility that Swaraj Engines is priced lower than what may be justified by its financials.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited is a company that manufactures and sells engineering systems, solutions, assemblies, and components for off-highway vehicles across various global markets including India, the United States, the Asia Pacific region, Europe, and Japan; it has a market capitalization of approximately ₹23.65 billion.

Operations: Uniparts India Limited generates revenue primarily from its linkage parts and components for off-highway vehicles, totaling ₹11.40 billion.

Dividend Yield: 3.7%

Uniparts India offers a promising dividend yield of 3.73%, ranking in the top quartile of Indian dividend payers. The company's dividends are well-supported with a payout ratio of 62.6% and a cash payout ratio of 53.9%. Despite recent dips in revenue and net income for FY 2024, with sales dropping to INR 11,395.35 million from INR 13,660.21 million year-over-year and net income falling to INR 1,246.88 million from INR 2,048.93 million, the firm maintains a lower price-to-earnings ratio than the market average at just 19 times earnings which suggests reasonable valuation levels relative to peers.

- Get an in-depth perspective on Uniparts India's performance by reading our dividend report here.

- The analysis detailed in our Uniparts India valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Access the full spectrum of 18 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether D. B is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DBCORP

D. B

Engages in newspaper printing and publishing, radio broadcasting, and provision of news digital platforms for news and event management businesses in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.