Stock Analysis

Indian Exchange Growth Companies With High Insider Ownership And Up To 24% Revenue Growth

Reviewed by Simply Wall St

Over the past year, the Indian market has experienced a robust increase of 45%, though it has remained flat in the last week. In this context, companies with high insider ownership and strong revenue growth can be particularly compelling, as these factors often signal confidence and potential resilience in changing market conditions.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.7% |

| Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Chalet Hotels (NSEI:CHALET) | 13.1% | 27.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Astral (NSEI:ASTRAL)

Simply Wall St Growth Rating: ★★★★★☆

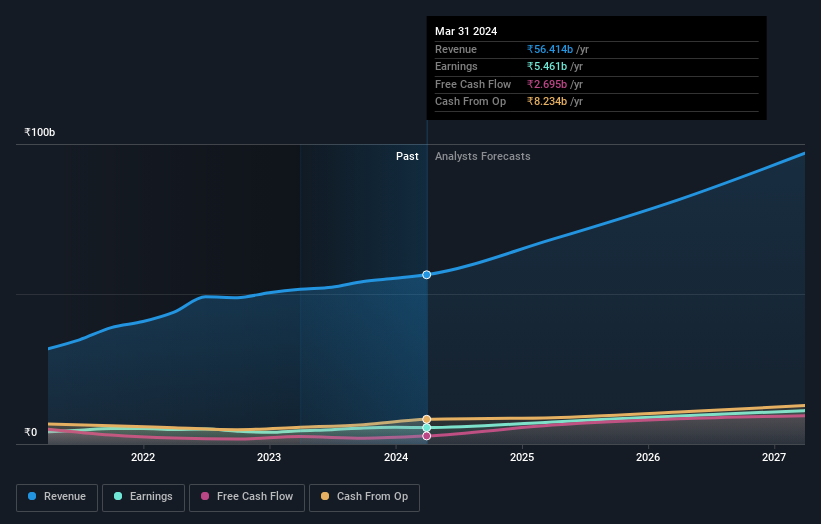

Overview: Astral Limited operates in the manufacturing and marketing of pipes, water tanks, and adhesives and sealants both domestically in India and internationally, with a market capitalization of approximately ₹649.47 billion.

Operations: The company generates revenue primarily through its plumbing segment, which contributes ₹41.42 billion, and its paints and adhesives segment, which adds another ₹14.99 billion.

Insider Ownership: 39.4%

Revenue Growth Forecast: 17.4% p.a.

Astral, a growth-oriented company in India, showcases robust financial performance with earnings and revenue growth rates surpassing the Indian market average. Over the past five years, earnings have expanded by 19.1% annually. Looking ahead, Astral's revenue is expected to grow at 17.4% per year and earnings at an impressive 23% per year over the next three years. Despite these strong indicators, insider transactions have been minimal recently, reflecting a potential area for investor caution.

- Delve into the full analysis future growth report here for a deeper understanding of Astral.

- Our expertly prepared valuation report Astral implies its share price may be too high.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited, with a market capitalization of approximately ₹868.72 billion, operates as an online classifieds company in sectors including recruitment, matrimony, real estate, and education both in India and internationally.

Operations: The company generates revenue primarily through Recruitment Solutions at ₹18.80 billion and 99acres for Real Estate at ₹3.51 billion.

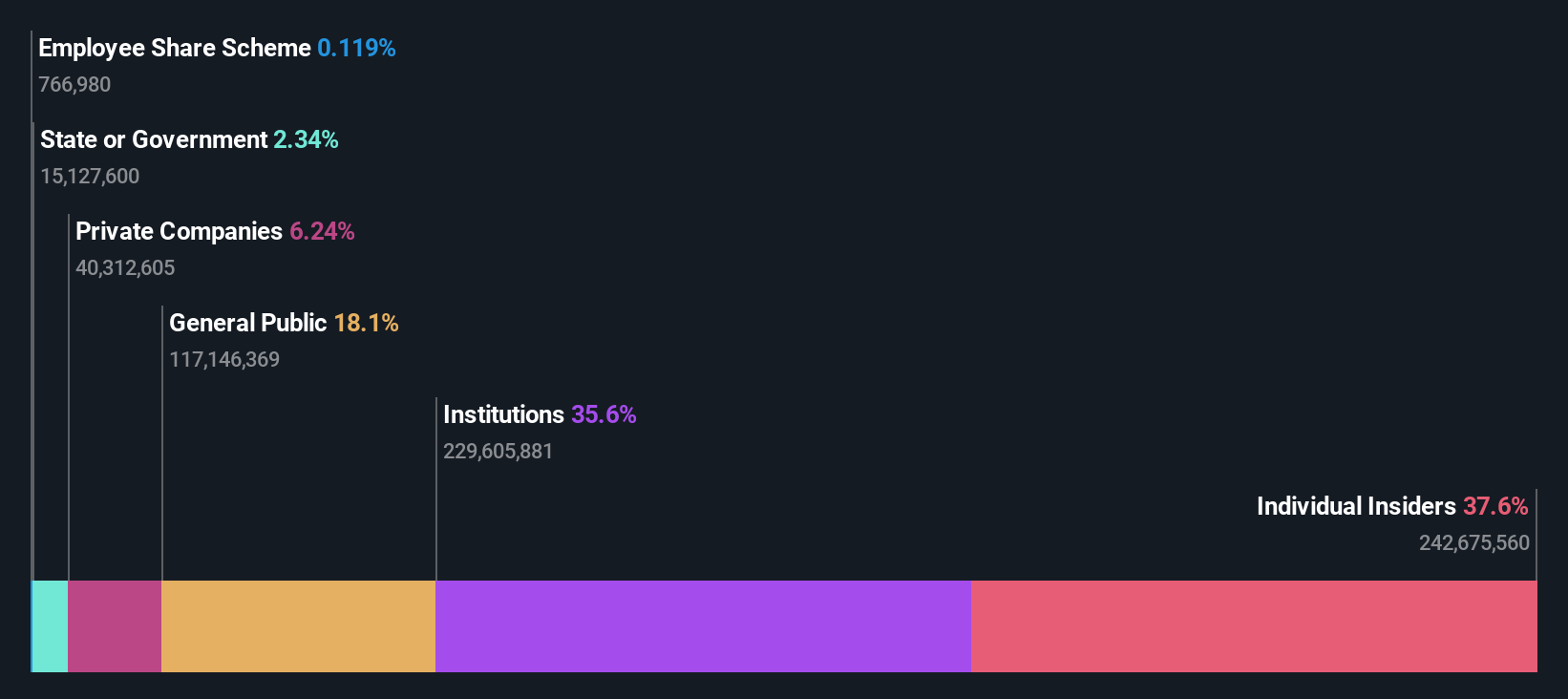

Insider Ownership: 37.9%

Revenue Growth Forecast: 12.1% p.a.

Info Edge (India) has shown a strong turnaround, reporting substantial profit growth and transitioning from a net loss to net income this year. With earnings expected to grow by 24.34% annually over the next three years, it outpaces the broader Indian market's growth. Despite high insider selling recently, Info Edge continues to attract attention with its improved financial performance and strategic presentations at major conferences, signaling robust operational momentum.

- Navigate through the intricacies of Info Edge (India) with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Info Edge (India)'s share price might be on the expensive side.

Titagarh Rail Systems (NSEI:TITAGARH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Titagarh Rail Systems Limited, operating both domestically and internationally, specializes in the manufacturing and sale of freight and passenger rail systems, with a market capitalization of approximately ₹244.80 billion.

Operations: The company generates ₹34.18 billion from its freight rail systems, which include shipbuilding, bridges, and defense sectors, and ₹4.36 billion from passenger rail systems.

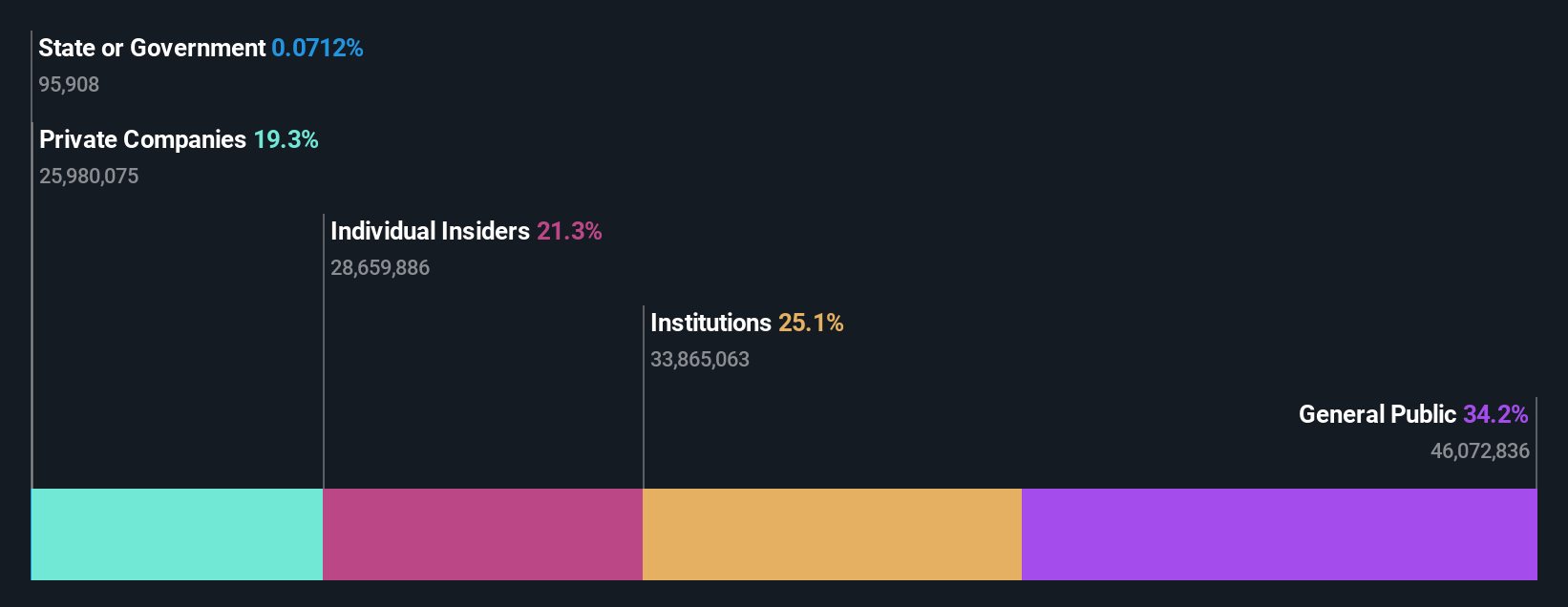

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.2% p.a.

Titagarh Rail Systems Limited, a key participant in India's rail sector, has demonstrated substantial growth with a recent 107.3% increase in annual earnings and an expected profit growth of 29.9% per year. Despite high volatility in share prices and no significant insider buying recently, the company continues to invest in innovation as shown by the inauguration of a new engineering center focused on advanced rail technologies. This aligns with national initiatives like 'Make-in-India', enhancing its growth prospects amidst some challenges like shareholder dilution over the past year.

- Click to explore a detailed breakdown of our findings in Titagarh Rail Systems' earnings growth report.

- Upon reviewing our latest valuation report, Titagarh Rail Systems' share price might be too optimistic.

Next Steps

- Unlock more gems! Our Fast Growing Indian Companies With High Insider Ownership screener has unearthed 81 more companies for you to explore.Click here to unveil our expertly curated list of 84 Fast Growing Indian Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Astral is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ASTRAL

Astral

Manufactures and markets pipes, water tanks, and adhesives and sealants in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.