There Could Be A Chance Cyber Media (India) Limited's (NSE:CYBERMEDIA) CEO Will Have Their Compensation Increased

Shareholders will be pleased by the robust performance of Cyber Media (India) Limited (NSE:CYBERMEDIA) recently and this will be kept in mind in the upcoming AGM on 30 September 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for Cyber Media (India)

Comparing Cyber Media (India) Limited's CEO Compensation With the industry

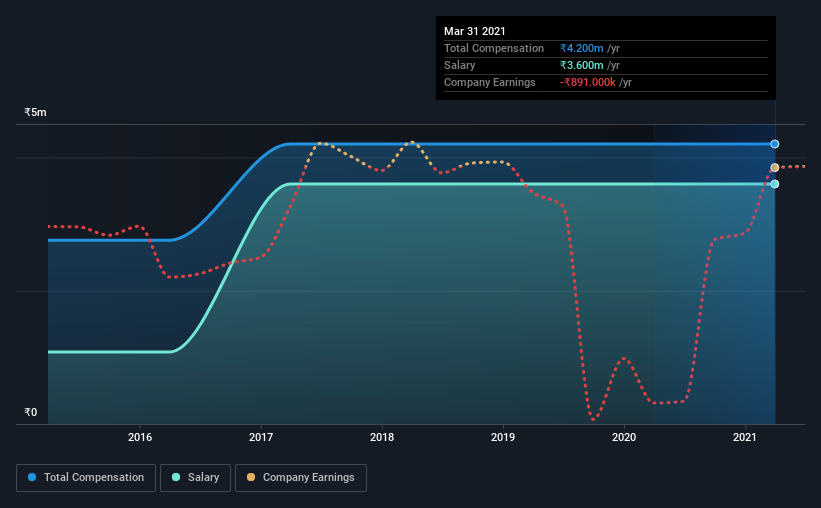

According to our data, Cyber Media (India) Limited has a market capitalization of ₹162m, and paid its CEO total annual compensation worth ₹4.2m over the year to March 2021. This was the same amount the CEO received in the prior year. We note that the salary portion, which stands at ₹3.60m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹11m. This suggests that Pradeep Gupta is paid below the industry median. What's more, Pradeep Gupta holds ₹78m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹3.6m | ₹3.6m | 86% |

| Other | ₹600k | ₹600k | 14% |

| Total Compensation | ₹4.2m | ₹4.2m | 100% |

Speaking on an industry level, nearly 98% of total compensation represents salary, while the remainder of 2% is other remuneration. Cyber Media (India) pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Cyber Media (India) Limited's Growth Numbers

Over the last three years, Cyber Media (India) Limited has shrunk its earnings per share by 20% per year. In the last year, its revenue is up 37%.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Cyber Media (India) Limited Been A Good Investment?

Cyber Media (India) Limited has served shareholders reasonably well, with a total return of 22% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 5 warning signs (and 3 which are a bit concerning) in Cyber Media (India) we think you should know about.

Important note: Cyber Media (India) is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Cyber Media (India) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CYBERMEDIA

Cyber Media (India)

Engages in the media business in India and internationally.

Medium-low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026