- India

- /

- Metals and Mining

- /

- NSEI:ZENITHSTL

Here's Why Zenith Steel Pipes & Industries (NSE:ZENITHSTL) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Zenith Steel Pipes & Industries (NSE:ZENITHSTL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Zenith Steel Pipes & Industries

Zenith Steel Pipes & Industries' Improving Profits

In the last three years Zenith Steel Pipes & Industries' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Zenith Steel Pipes & Industries' EPS shot from ₹0.39 to ₹1.12, over the last year. It's not often a company can achieve year-on-year growth of 187%. That could be a sign that the business has reached a true inflection point.

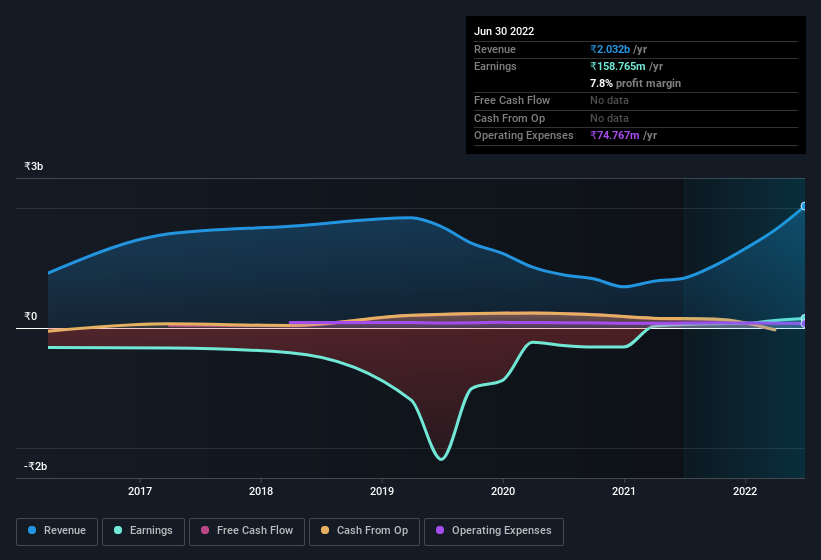

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Zenith Steel Pipes & Industries shareholders is that EBIT margins have grown from -2.2% to 6.9% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Zenith Steel Pipes & Industries is no giant, with a market capitalisation of ₹828m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Zenith Steel Pipes & Industries Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations under ₹16b, like Zenith Steel Pipes & Industries, the median CEO pay is around ₹3.0m.

The CEO of Zenith Steel Pipes & Industries was paid just ₹250k in total compensation for the year ending March 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Zenith Steel Pipes & Industries To Your Watchlist?

Zenith Steel Pipes & Industries' earnings per share growth have been climbing higher at an appreciable rate. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that Zenith Steel Pipes & Industries has the hallmarks of a quality business; and that would make it well worth watching. We should say that we've discovered 5 warning signs for Zenith Steel Pipes & Industries (3 don't sit too well with us!) that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zenith Steel Pipes & Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZENITHSTL

Zenith Steel Pipes & Industries

Manufactures and sells steel pipes in India and internationally.

Slight with acceptable track record.

Market Insights

Community Narratives