- India

- /

- Metals and Mining

- /

- NSEI:VEDL

3 Undervalued Stocks On The Indian Exchange With Discounts Up To 45.1%

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.3%, driven by gains in the Materials and Energy sectors of 2.7% and 3.9%, respectively. With the market up 45% over the past 12 months and earnings forecasted to grow by 17% annually, identifying undervalued stocks can be a strategic move for investors seeking opportunities amidst these positive trends.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹193.28 | ₹306.18 | 36.9% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2167.90 | ₹4289.83 | 49.5% |

| Apollo Pipes (BSE:531761) | ₹578.55 | ₹1136.33 | 49.1% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1221.85 | ₹2153.18 | 43.3% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹474.65 | ₹762.32 | 37.7% |

| Vedanta (NSEI:VEDL) | ₹512.65 | ₹933.79 | 45.1% |

| Patel Engineering (BSE:531120) | ₹57.02 | ₹92.67 | 38.5% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1367.70 | ₹2142.32 | 36.2% |

| Tarsons Products (NSEI:TARSONS) | ₹443.50 | ₹708.42 | 37.4% |

| Strides Pharma Science (NSEI:STAR) | ₹1399.00 | ₹2704.30 | 48.3% |

Let's take a closer look at a couple of our picks from the screened companies.

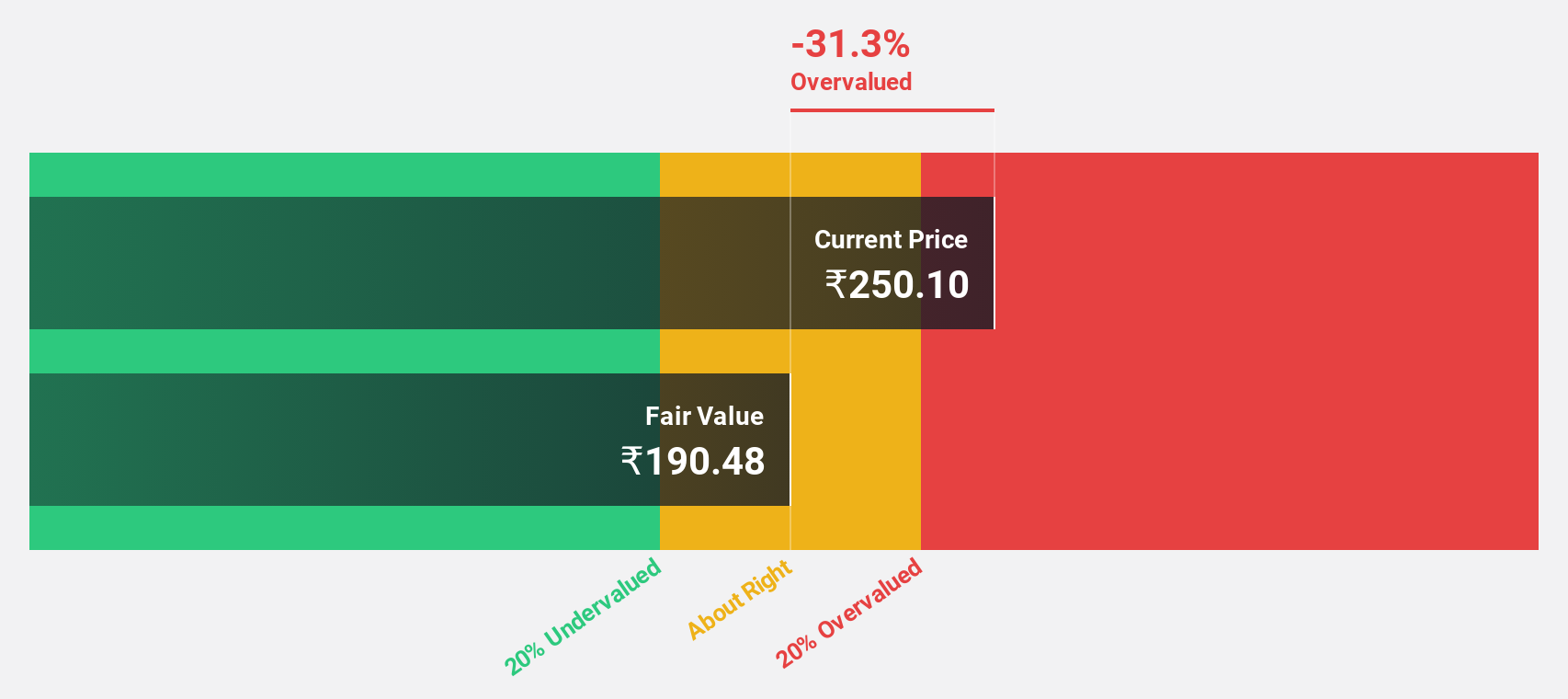

Artemis Medicare Services (NSEI:ARTEMISMED)

Overview: Artemis Medicare Services Limited manages and operates multi-specialty hospitals in India and internationally, with a market cap of ₹39.13 billion.

Operations: Artemis Medicare Services Limited generates revenue primarily from healthcare services, amounting to ₹8.92 billion.

Estimated Discount To Fair Value: 36.1%

Artemis Medicare Services is trading at ₹284.4, significantly below its estimated fair value of ₹445.15, making it an undervalued stock based on cash flows. The company reported strong earnings growth of 40% over the past year and forecasts suggest a continued annual profit growth of 36.5%, outpacing the Indian market's average of 17.2%. Despite high debt levels, recent inclusion in the S&P Global BMI Index adds to its attractiveness for investors seeking undervalued opportunities.

- Our expertly prepared growth report on Artemis Medicare Services implies its future financial outlook may be stronger than recent results.

- Take a closer look at Artemis Medicare Services' balance sheet health here in our report.

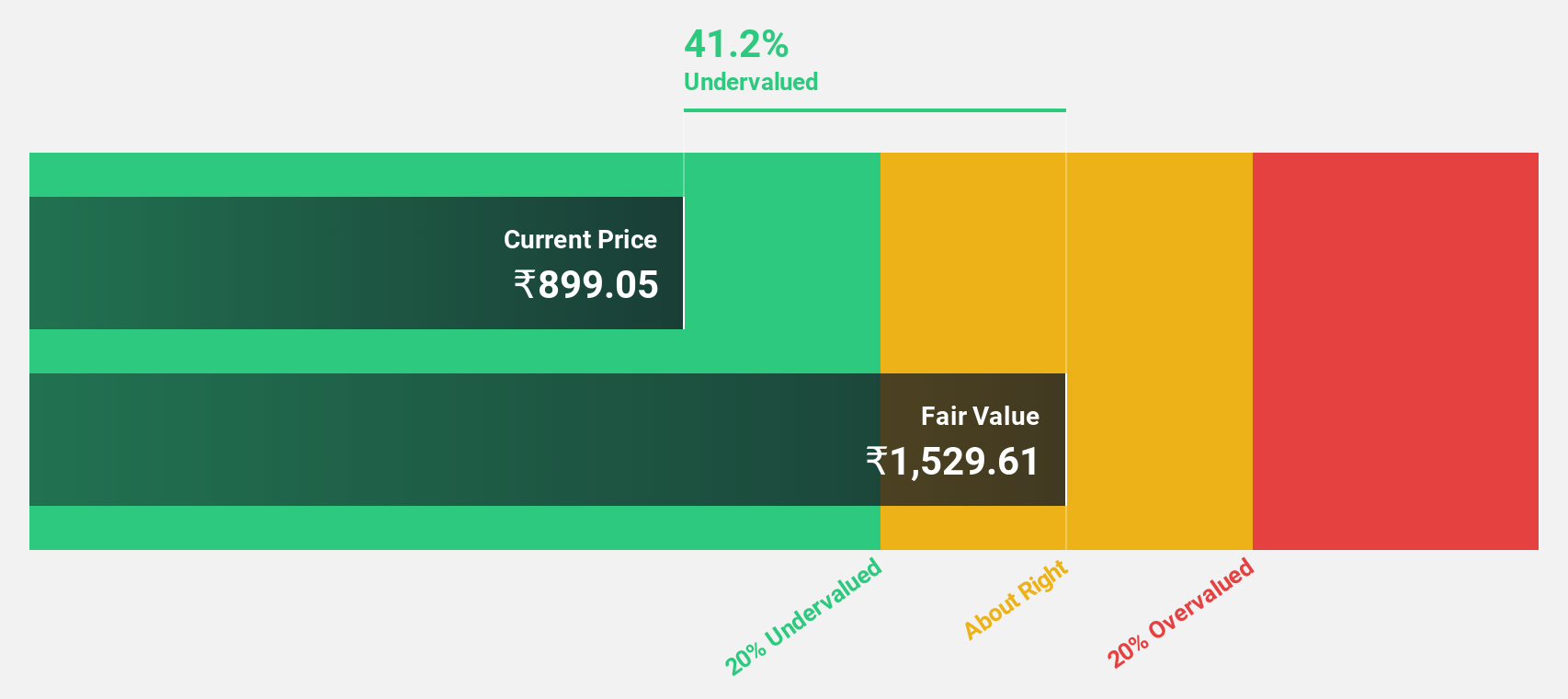

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited operates in the steel, mining, and infrastructure sectors both in India and internationally, with a market cap of ₹1.06 trillion.

Operations: The company generates revenue primarily from manufacturing steel products, amounting to ₹510.56 billion.

Estimated Discount To Fair Value: 13.4%

Jindal Steel & Power (₹1039.65) is trading below its estimated fair value of ₹1200.98, indicating it may be undervalued based on cash flows. Earnings grew by 95% over the past year and are forecast to grow significantly at 24% annually, outpacing the Indian market's average of 17.2%. Recent strategic alliances for green hydrogen integration further bolster its long-term sustainability efforts, potentially enhancing future cash flows and reducing carbon footprint significantly.

- In light of our recent growth report, it seems possible that Jindal Steel & Power's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Jindal Steel & Power.

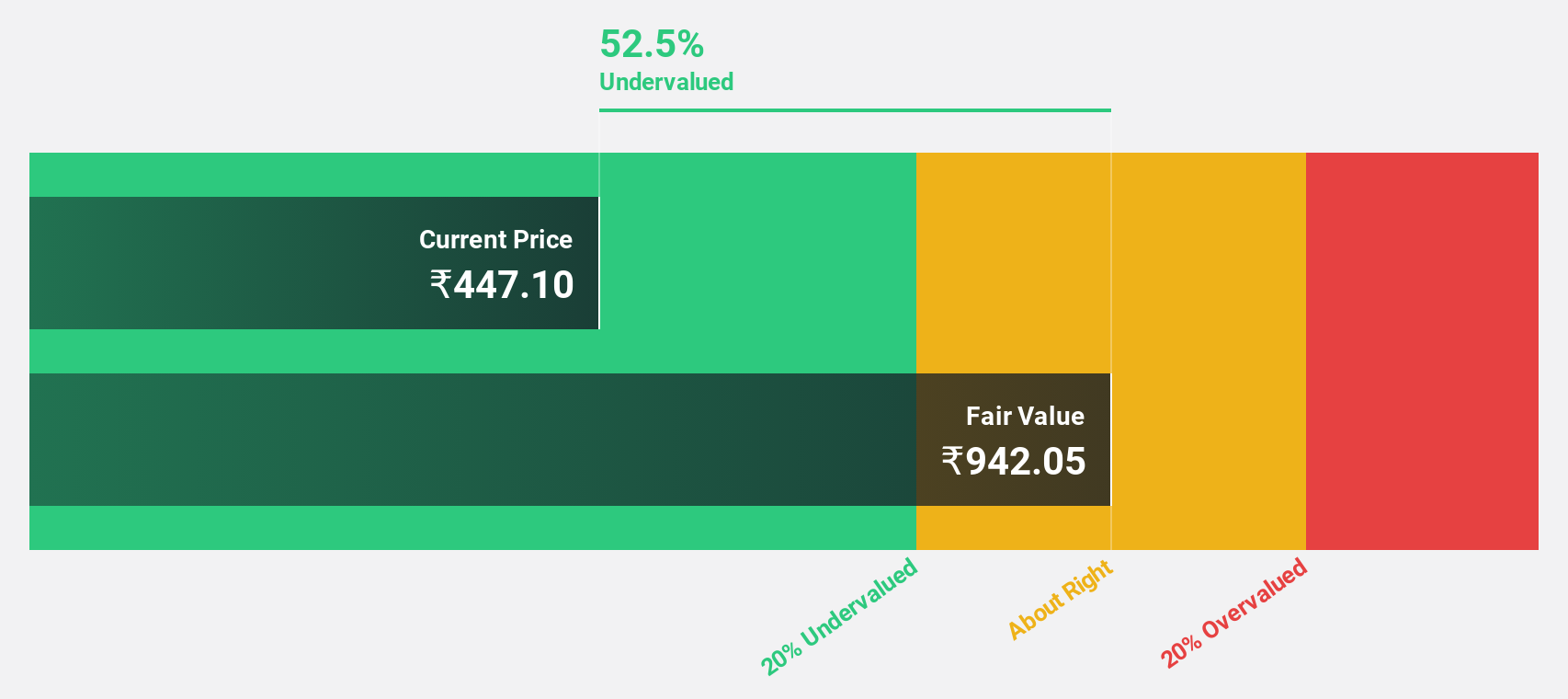

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited, a diversified natural resources company with a market cap of ₹2.00 trillion, explores, extracts, and processes minerals and oil and gas in India and internationally.

Operations: Vedanta Limited generates revenue from several key segments, including Power (₹62.54 billion), Copper (₹197.31 billion), Iron Ore (₹83.51 billion), Aluminium (₹499.81 billion), Oil and Gas (₹179.05 billion), and Zinc - International (₹32.06 billion).

Estimated Discount To Fair Value: 45.1%

Vedanta Limited (₹512.65) is trading significantly below its estimated fair value of ₹933.79, highlighting potential undervaluation based on cash flows. Despite a high debt level and shareholder dilution in the past year, earnings are forecast to grow 41.84% annually, outpacing the Indian market's average of 17.2%. The proposed demerger into separate listed entities could simplify its corporate structure and attract direct investments, though recent tax penalties may impact short-term financials.

- Our comprehensive growth report raises the possibility that Vedanta is poised for substantial financial growth.

- Navigate through the intricacies of Vedanta with our comprehensive financial health report here.

Seize The Opportunity

- Unlock our comprehensive list of 26 Undervalued Indian Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VEDL

Vedanta

A diversified natural resources company, explores, extracts, and processes minerals, and oil and gas in India, Europe, China, the United States, Mexico, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives