- India

- /

- Metals and Mining

- /

- NSEI:USHAMART

We Take A Look At Why Usha Martin Limited's (NSE:USHAMART) CEO Compensation Is Well Earned

We have been pretty impressed with the performance at Usha Martin Limited (NSE:USHAMART) recently and CEO Rajeev Jhawar deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 11 August 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

See our latest analysis for Usha Martin

How Does Total Compensation For Rajeev Jhawar Compare With Other Companies In The Industry?

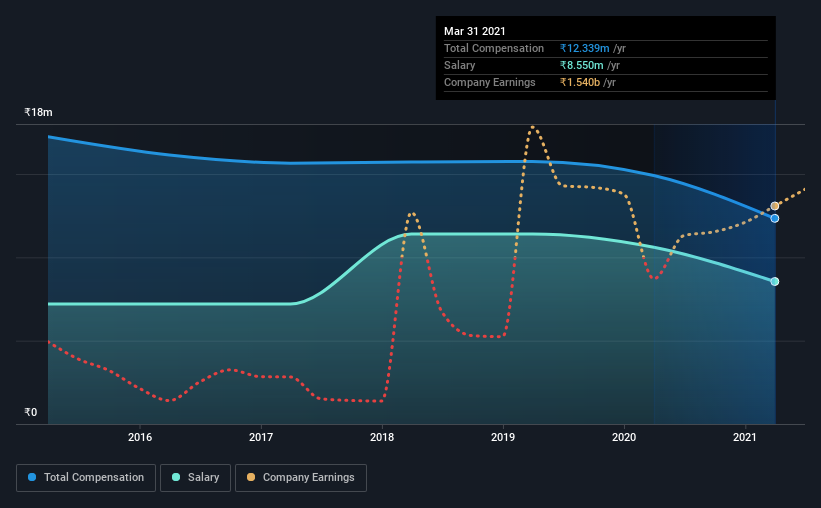

Our data indicates that Usha Martin Limited has a market capitalization of ₹21b, and total annual CEO compensation was reported as ₹12m for the year to March 2021. We note that's a decrease of 17% compared to last year. We note that the salary portion, which stands at ₹8.55m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between ₹7.4b and ₹30b had a median total CEO compensation of ₹15m. From this we gather that Rajeev Jhawar is paid around the median for CEOs in the industry. Furthermore, Rajeev Jhawar directly owns ₹365m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹8.6m | ₹11m | 69% |

| Other | ₹3.8m | ₹4.3m | 31% |

| Total Compensation | ₹12m | ₹15m | 100% |

Talking in terms of the industry, salary represented approximately 100% of total compensation out of all the companies we analyzed, while other remuneration made up 0.3946% of the pie. Usha Martin sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Usha Martin Limited's Growth

Usha Martin Limited has seen its earnings per share (EPS) increase by 50% a year over the past three years. In the last year, its revenue is up 19%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Usha Martin Limited Been A Good Investment?

Boasting a total shareholder return of 141% over three years, Usha Martin Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Usha Martin that investors should be aware of in a dynamic business environment.

Switching gears from Usha Martin, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Usha Martin, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:USHAMART

Usha Martin

Manufactures and sells steel wires, strands, wire ropes, and cord related accessories in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives