- India

- /

- Metals and Mining

- /

- NSEI:USHAMART

Usha Martin Limited's (NSE:USHAMART) Prospects Need A Boost To Lift Shares

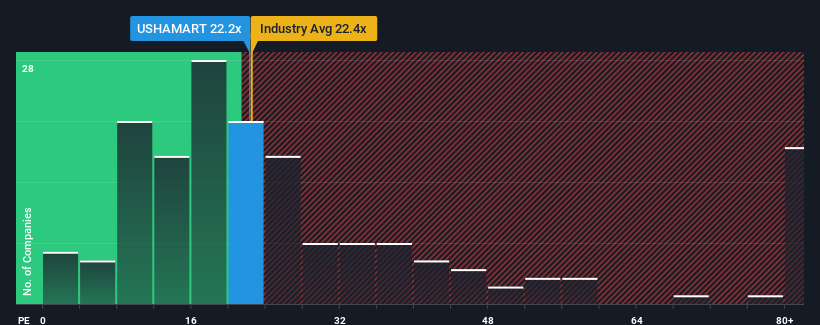

With a price-to-earnings (or "P/E") ratio of 22.2x Usha Martin Limited (NSE:USHAMART) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 30x and even P/E's higher than 56x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

There hasn't been much to differentiate Usha Martin's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

View our latest analysis for Usha Martin

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Usha Martin's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. The strong recent performance means it was also able to grow EPS by 419% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 16% per year over the next three years. With the market predicted to deliver 19% growth per year, the company is positioned for a weaker earnings result.

With this information, we can see why Usha Martin is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Usha Martin's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Usha Martin's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Usha Martin you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:USHAMART

Usha Martin

Manufactures and sells steel wires, strands, wire ropes, and cord related accessories in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives