Did You Participate In Any Of Thirumalai Chemicals' (NSE:TIRUMALCHM) Incredible 429% Return?

Thirumalai Chemicals Limited (NSE:TIRUMALCHM) shareholders might be concerned after seeing the share price drop 13% in the last month. But that does not change the realty that the stock's performance has been terrific, over five years. Indeed, the share price is up a whopping 382% in that time. So we don't think the recent decline in the share price means its story is a sad one. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 56% decline over the last three years: that's a long time to wait for profits.

Check out our latest analysis for Thirumalai Chemicals

Thirumalai Chemicals wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Thirumalai Chemicals can boast revenue growth at a rate of 3.1% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 37% per year, compound, over the period. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

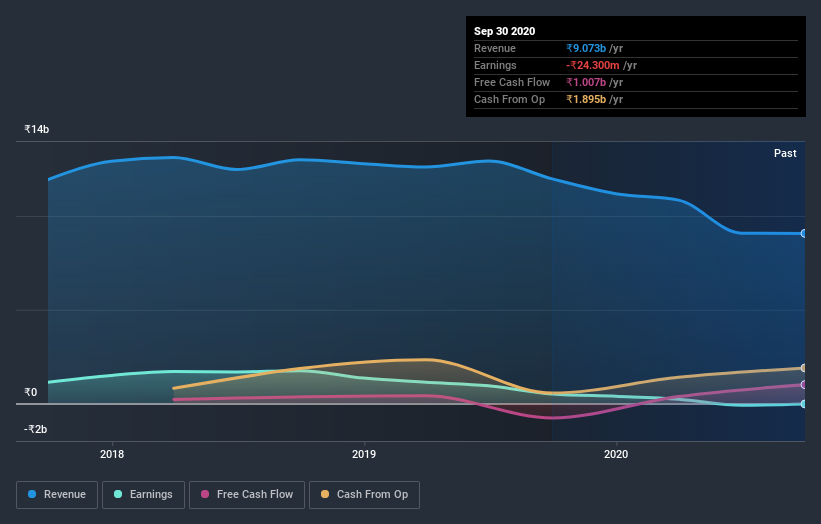

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Thirumalai Chemicals stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Thirumalai Chemicals' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Thirumalai Chemicals' TSR of 429% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Thirumalai Chemicals shareholders have received a total shareholder return of 36% over one year. However, that falls short of the 40% TSR per annum it has made for shareholders, each year, over five years. It's always interesting to track share price performance over the longer term. But to understand Thirumalai Chemicals better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Thirumalai Chemicals .

But note: Thirumalai Chemicals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Thirumalai Chemicals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thirumalai Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TIRUMALCHM

Thirumalai Chemicals

Manufactures and sells organic chemicals in India and internationally.

Slightly overvalued very low.

Similar Companies

Market Insights

Community Narratives