Most Shareholders Will Probably Agree With Tata Chemicals Limited's (NSE:TATACHEM) CEO Compensation

The share price of Tata Chemicals Limited (NSE:TATACHEM) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. The upcoming AGM on 02 July 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for Tata Chemicals

How Does Total Compensation For Ramakrishnan Mukundan Compare With Other Companies In The Industry?

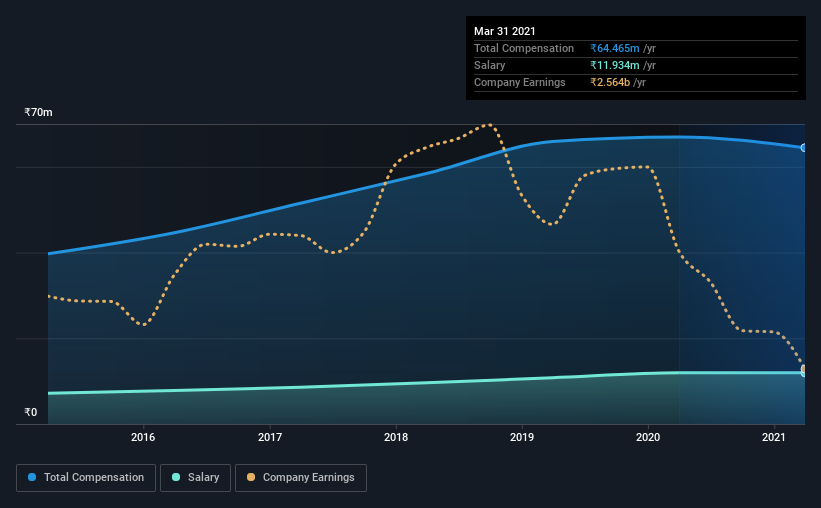

According to our data, Tata Chemicals Limited has a market capitalization of ₹182b, and paid its CEO total annual compensation worth ₹64m over the year to March 2021. That's slightly lower by 3.7% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹12m.

On comparing similar companies from the same industry with market caps ranging from ₹148b to ₹475b, we found that the median CEO total compensation was ₹64m. This suggests that Tata Chemicals remunerates its CEO largely in line with the industry average.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹12m | ₹12m | 19% |

| Other | ₹53m | ₹55m | 81% |

| Total Compensation | ₹64m | ₹67m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. It's interesting to note that Tata Chemicals allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Tata Chemicals Limited's Growth Numbers

Over the last three years, Tata Chemicals Limited has shrunk its earnings per share by 42% per year. It saw its revenue drop 1.5% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Tata Chemicals Limited Been A Good Investment?

We think that the total shareholder return of 157%, over three years, would leave most Tata Chemicals Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 3 warning signs for Tata Chemicals that investors should be aware of in a dynamic business environment.

Important note: Tata Chemicals is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Tata Chemicals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tata Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:TATACHEM

Tata Chemicals

Manufactures, markets, sells, and distributes basic chemistry and specialty products in India, Europe, Africa, America, rest of Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives