We Think Some Shareholders May Hesitate To Increase Sree Rayalaseema Hi-Strength Hypo Limited's (NSE:SRHHYPOLTD) CEO Compensation

Key Insights

- Sree Rayalaseema Hi-Strength Hypo's Annual General Meeting to take place on 26th of September

- CEO Tumbalam Bharath's total compensation includes salary of ₹89.1m

- The total compensation is 1,385% higher than the average for the industry

- Sree Rayalaseema Hi-Strength Hypo's total shareholder return over the past three years was 279% while its EPS grew by 48% over the past three years

Performance at Sree Rayalaseema Hi-Strength Hypo Limited (NSE:SRHHYPOLTD) has been reasonably good and CEO Tumbalam Bharath has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 26th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Sree Rayalaseema Hi-Strength Hypo

How Does Total Compensation For Tumbalam Bharath Compare With Other Companies In The Industry?

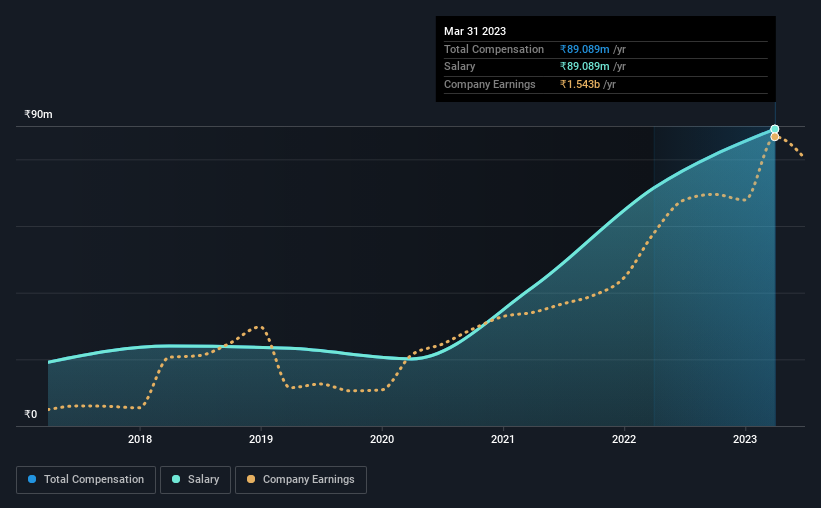

According to our data, Sree Rayalaseema Hi-Strength Hypo Limited has a market capitalization of ₹10b, and paid its CEO total annual compensation worth ₹89m over the year to March 2023. Notably, that's an increase of 25% over the year before. Notably, the salary of ₹89m is the entirety of the CEO compensation.

On comparing similar-sized companies in the Indian Chemicals industry with market capitalizations below ₹17b, we found that the median total CEO compensation was ₹6.0m. Accordingly, our analysis reveals that Sree Rayalaseema Hi-Strength Hypo Limited pays Tumbalam Bharath north of the industry median. What's more, Tumbalam Bharath holds ₹313m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹89m | ₹71m | 100% |

| Other | - | - | - |

| Total Compensation | ₹89m | ₹71m | 100% |

Speaking on an industry level, nearly 86% of total compensation represents salary, while the remainder of 14% is other remuneration. Speaking on a company level, Sree Rayalaseema Hi-Strength Hypo prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Sree Rayalaseema Hi-Strength Hypo Limited's Growth

Sree Rayalaseema Hi-Strength Hypo Limited has seen its earnings per share (EPS) increase by 48% a year over the past three years. In the last year, its revenue is down 13%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Sree Rayalaseema Hi-Strength Hypo Limited Been A Good Investment?

We think that the total shareholder return of 279%, over three years, would leave most Sree Rayalaseema Hi-Strength Hypo Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Sree Rayalaseema Hi-Strength Hypo rewards its CEO solely through a salary, ignoring non-salary benefits completely. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Sree Rayalaseema Hi-Strength Hypo that you should be aware of before investing.

Important note: Sree Rayalaseema Hi-Strength Hypo is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SRHHYPOLTD

Sree Rayalaseema Hi-Strength Hypo

Produces and sells industrial chemicals in India.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion