Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Sikko Industries Limited (NSE:SIKKO) share price is down 26% in the last year. That falls noticeably short of the market return of around 2.8%. Because Sikko Industries hasn't been listed for many years, the market is still learning about how the business performs. There was little comfort for shareholders in the last week as the price declined a further 1.1%.

See our latest analysis for Sikko Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Sikko Industries share price fell, it actually saw its earnings per share (EPS) improve by 68%. It's quite possible that growth expectations may have been unreasonable in the past. It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Sikko Industries managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

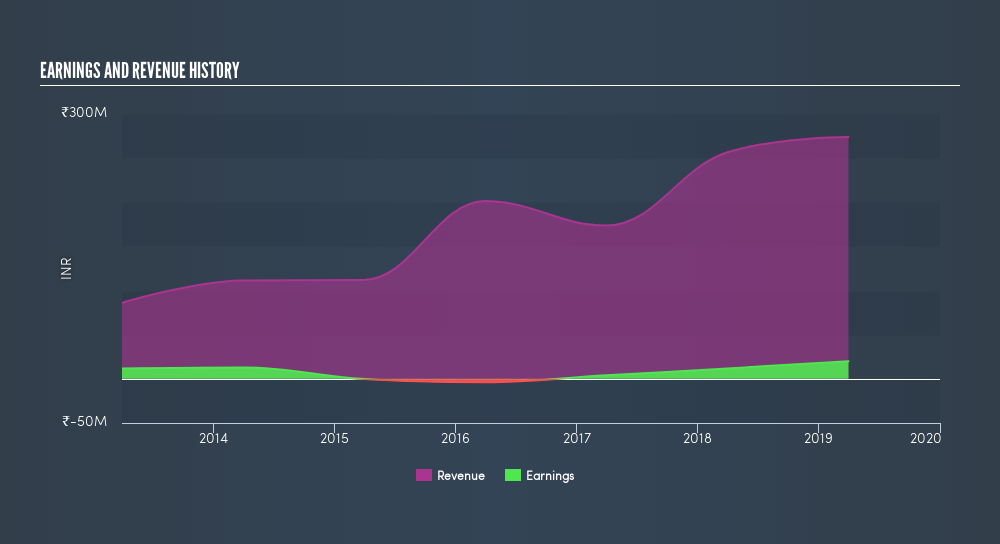

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Sikko Industries's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Sikko Industries shareholders are down 26% for the year, the market itself is up 2.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 6.9%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Before forming an opinion on Sikko Industries you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SIKKO

Sikko Industries

Manufactures and trades in bio-agro chemicals, pesticides, fertilizers, seeds, sprayers, packaging, machineries, and FMCG products for agriculture in India and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives