- India

- /

- Paper and Forestry Products

- /

- NSEI:SESHAPAPER

Should You Buy Seshasayee Paper and Boards Limited (NSE:SESHAPAPER) For Its Upcoming Dividend In 3 Days?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Seshasayee Paper and Boards Limited (NSE:SESHAPAPER) is about to trade ex-dividend in the next 3 days. You will need to purchase shares before the 16th of July to receive the dividend, which will be paid on the 29th of July.

Seshasayee Paper and Boards's next dividend payment will be ₹20.00 per share. Last year, in total, the company distributed ₹20.00 to shareholders. Calculating the last year's worth of payments shows that Seshasayee Paper and Boards has a trailing yield of 2.1% on the current share price of ₹973.95. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Seshasayee Paper and Boards

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Seshasayee Paper and Boards has a low and conservative payout ratio of just 13% of its income after tax. A useful secondary check can be to evaluate whether Seshasayee Paper and Boards generated enough free cash flow to afford its dividend. The good news is it paid out just 7.8% of its free cash flow in the last year.

It's positive to see that Seshasayee Paper and Boards's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Seshasayee Paper and Boards paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Seshasayee Paper and Boards has grown its earnings rapidly, up 63% a year for the past five years.

With earnings per share growing rapidly and the company sensibly reinvesting almost all of its profits within the business, Seshasayee Paper and Boards looks like a promising growth company.

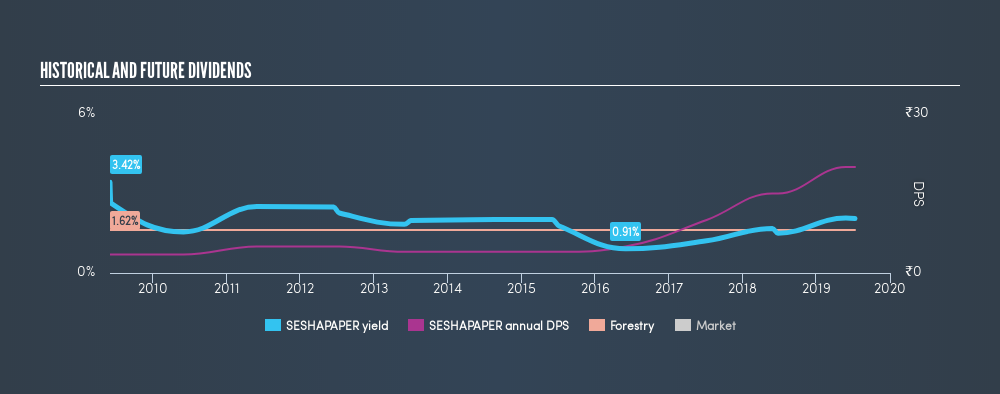

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Seshasayee Paper and Boards has lifted its dividend by approximately 19% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Should investors buy Seshasayee Paper and Boards for the upcoming dividend? Seshasayee Paper and Boards has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past ten years, but the conservative payout ratio makes the current dividend look sustainable. Seshasayee Paper and Boards looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

Curious about whether Seshasayee Paper and Boards has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:SESHAPAPER

Seshasayee Paper and Boards

Engages in the manufacture and sale of printing and writing paper in India.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.