- India

- /

- Metals and Mining

- /

- NSEI:AEROENTER

What You Can Learn From Sat Industries Limited's (NSE:SATINDLTD) P/S After Its 28% Share Price Crash

Sat Industries Limited (NSE:SATINDLTD) shares have had a horrible month, losing 28% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 10% in the last year.

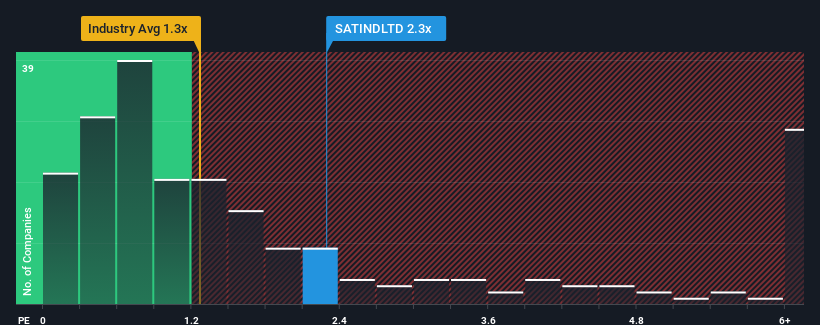

In spite of the heavy fall in price, given close to half the companies operating in India's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.3x, you may still consider Sat Industries as a stock to potentially avoid with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sat Industries

How Has Sat Industries Performed Recently?

Sat Industries has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sat Industries will help you shine a light on its historical performance.How Is Sat Industries' Revenue Growth Trending?

In order to justify its P/S ratio, Sat Industries would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.0% last year. This was backed up an excellent period prior to see revenue up by 96% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Sat Industries' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

There's still some elevation in Sat Industries' P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sat Industries maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Sat Industries has 4 warning signs (and 1 which is concerning) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AEROENTER

Aeroflex Enterprises

Manufactures and sells stainless-steel flexible hoses and assemblies in India, the Middle East, Europe, Asia, Africa, the United States, Latin and Central America, the Caribbean Islands, Australia, and North America.

Flawless balance sheet and good value.

Market Insights

Community Narratives