- India

- /

- Metals and Mining

- /

- NSEI:SATHAISPAT

We Discuss Why Sathavahana Ispat Limited's (NSE:SATHAISPAT) CEO Compensation May Be Closely Reviewed

Shareholders will probably not be too impressed with the underwhelming results at Sathavahana Ispat Limited (NSE:SATHAISPAT) recently. At the upcoming AGM on 31 January 2022, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Sathavahana Ispat

Comparing Sathavahana Ispat Limited's CEO Compensation With the industry

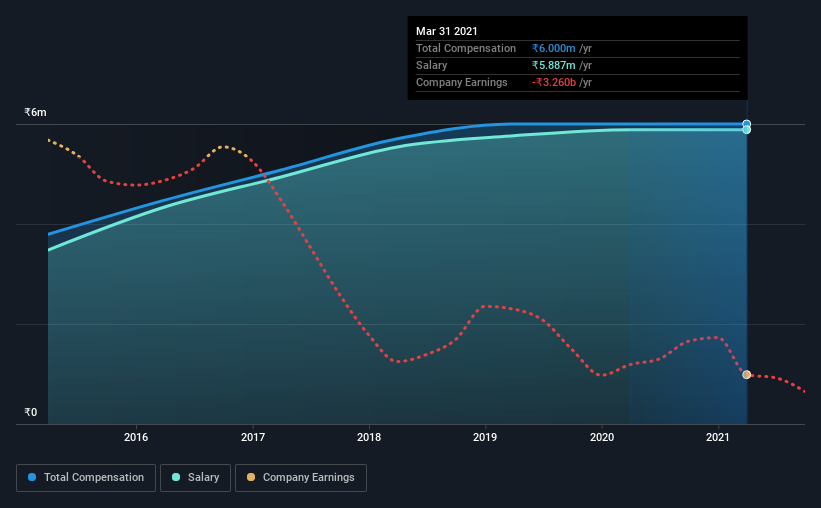

At the time of writing, our data shows that Sathavahana Ispat Limited has a market capitalization of ₹191m, and reported total annual CEO compensation of ₹6.0m for the year to March 2021. This was the same as last year. Notably, the salary which is ₹5.89m, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below ₹15b, reported a median total CEO compensation of ₹3.0m. Hence, we can conclude that Naresh Adusumilli is remunerated higher than the industry median. What's more, Naresh Adusumilli holds ₹14m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹5.9m | ₹5.9m | 98% |

| Other | ₹113k | ₹113k | 2% |

| Total Compensation | ₹6.0m | ₹6.0m | 100% |

On an industry level, around 100% of total compensation represents salary and 0.3493% is other remuneration. Sathavahana Ispat has gone down a largely traditional route, paying Naresh Adusumilli a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Sathavahana Ispat Limited's Growth

Over the last three years, Sathavahana Ispat Limited has shrunk its earnings per share by 11% per year. It saw its revenue drop 75% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Sathavahana Ispat Limited Been A Good Investment?

Few Sathavahana Ispat Limited shareholders would feel satisfied with the return of -59% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Naresh receives almost all of their compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 4 which are concerning) in Sathavahana Ispat we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SATHAISPAT

Sathavahana Ispat

Sathavahana Ispat Limited manufactures and sells pig iron, ductile iron pipes, and metallurgical coke in India.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives