- India

- /

- Metals and Mining

- /

- NSEI:SANDUMA

What The Sandur Manganese & Iron Ores Limited's (NSE:SANDUMA) 29% Share Price Gain Is Not Telling You

Those holding The Sandur Manganese & Iron Ores Limited (NSE:SANDUMA) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

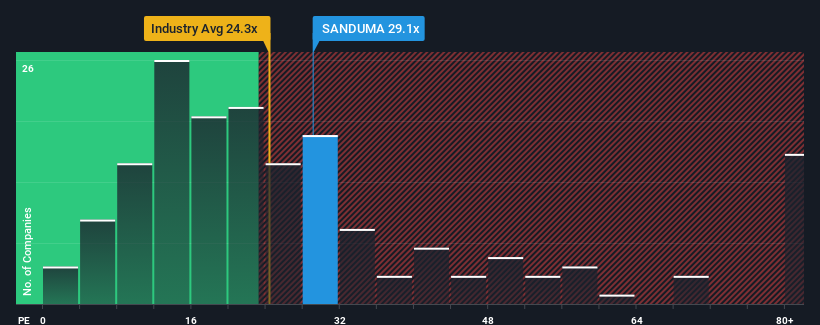

Although its price has surged higher, there still wouldn't be many who think Sandur Manganese & Iron Ores' price-to-earnings (or "P/E") ratio of 29.1x is worth a mention when the median P/E in India is similar at about 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Sandur Manganese & Iron Ores' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Sandur Manganese & Iron Ores

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Sandur Manganese & Iron Ores' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 34% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Sandur Manganese & Iron Ores' P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Sandur Manganese & Iron Ores appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sandur Manganese & Iron Ores currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Sandur Manganese & Iron Ores you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SANDUMA

Sandur Manganese & Iron Ores

Together with its subsidiary, engages in the mining of manganese and iron ores in Deogiri village of Ballari District, Karnataka.

Flawless balance sheet with solid track record and pays a dividend.