- India

- /

- Basic Materials

- /

- NSEI:SAGCEM

Investors Aren't Entirely Convinced By Sagar Cements Limited's (NSE:SAGCEM) Revenues

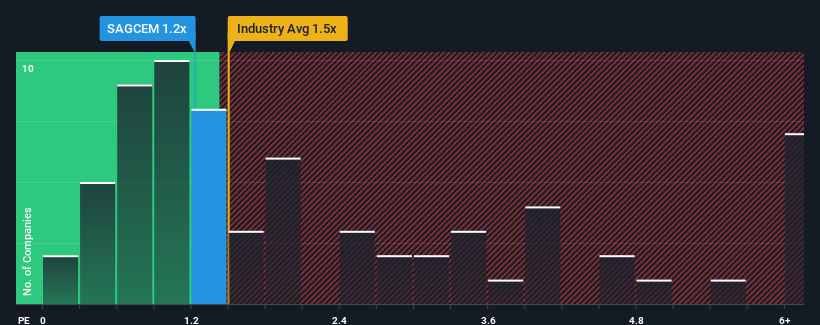

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Basic Materials industry in India, you could be forgiven for feeling indifferent about Sagar Cements Limited's (NSE:SAGCEM) P/S ratio of 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Sagar Cements

How Has Sagar Cements Performed Recently?

Recent revenue growth for Sagar Cements has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Sagar Cements' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sagar Cements' to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 92% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 29%. With the rest of the industry predicted to shrink by 12%, that would be a fantastic result.

With this in mind, we find it intriguing that Sagar Cements' P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sagar Cements currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 3 warning signs we've spotted with Sagar Cements (including 1 which is a bit unpleasant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SAGCEM

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives