David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Ramkrishna Forgings Limited (NSE:RKFORGE) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Ramkrishna Forgings

What Is Ramkrishna Forgings's Net Debt?

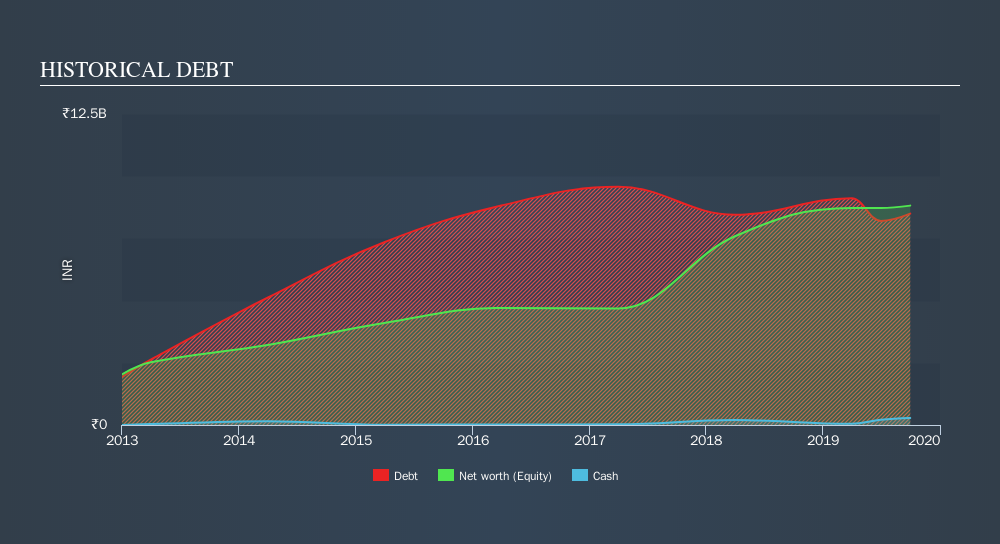

You can click the graphic below for the historical numbers, but it shows that Ramkrishna Forgings had ₹8.49b of debt in September 2019, down from ₹9.12b, one year before. However, because it has a cash reserve of ₹277.6m, its net debt is less, at about ₹8.22b.

A Look At Ramkrishna Forgings's Liabilities

We can see from the most recent balance sheet that Ramkrishna Forgings had liabilities of ₹7.72b falling due within a year, and liabilities of ₹5.38b due beyond that. Offsetting this, it had ₹277.6m in cash and ₹4.26b in receivables that were due within 12 months. So it has liabilities totalling ₹8.56b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of ₹9.29b, so it does suggest shareholders should keep an eye on Ramkrishna Forgings's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Ramkrishna Forgings has a debt to EBITDA ratio of 2.6 and its EBIT covered its interest expense 3.2 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The bad news is that Ramkrishna Forgings saw its EBIT decline by 18% over the last year. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Ramkrishna Forgings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Ramkrishna Forgings basically broke even on a free cash flow basis. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

Our View

On the face of it, Ramkrishna Forgings's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least its net debt to EBITDA is not so bad. We're quite clear that we consider Ramkrishna Forgings to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Ramkrishna Forgings's earnings per share history for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:RKFORGE

Ramkrishna Forgings

Engages in the manufacture and sale of forged components for automobiles, railway wagons and coaches, and engineering parts in India and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives