Responsive Industries' (NSE:RESPONIND) Earnings Are Growing But Is There More To The Story?

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Responsive Industries (NSE:RESPONIND).

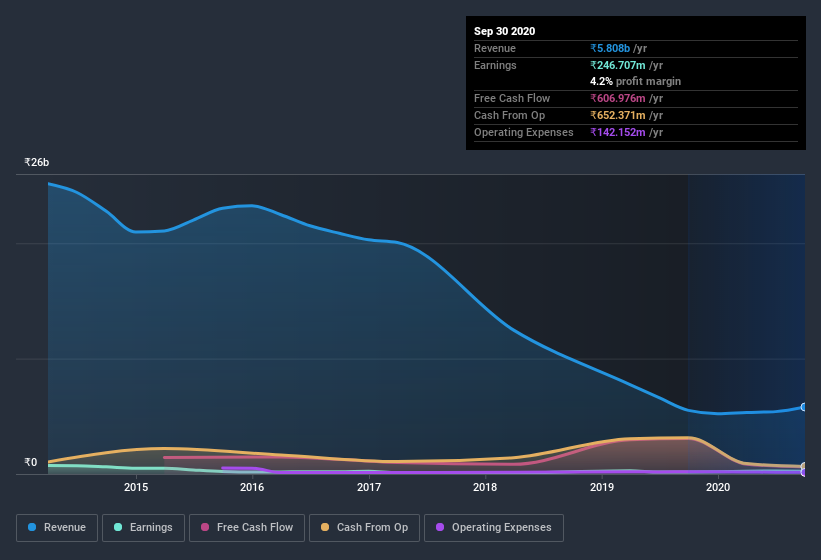

It's good to see that over the last twelve months Responsive Industries made a profit of ₹246.7m on revenue of ₹5.81b. Even though its revenue is down over the last three years, its profit has actually increased, as you can see, below.

View our latest analysis for Responsive Industries

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article, will discuss how a tax benefit impacted Responsive Industries' most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Responsive Industries.

An Unusual Tax Situation

We can see that Responsive Industries received a tax benefit of ₹17m. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Responsive Industries' Profit Performance

Responsive Industries reported that it received a tax benefit, rather than paid tax, in its last report. Given that sort of benefit is not recurring, a focus on the statutory profit might make the company seem better than it really is. Therefore, it seems possible to us that Responsive Industries' true underlying earnings power is actually less than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. While earnings are important, another area to consider is the balance sheet. If you're interested we have a graphic representation of Responsive Industries' balance sheet.

This note has only looked at a single factor that sheds light on the nature of Responsive Industries' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Responsive Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RESPONIND

Responsive Industries

Manufactures and sells polyvinyl chloride (PVC) based products in India.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026