- India

- /

- Basic Materials

- /

- NSEI:REFRACTORY

Refractory Shapes Limited (NSE:REFRACTORY) Held Back By Insufficient Growth Even After Shares Climb 37%

Refractory Shapes Limited (NSE:REFRACTORY) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 54% share price drop in the last twelve months.

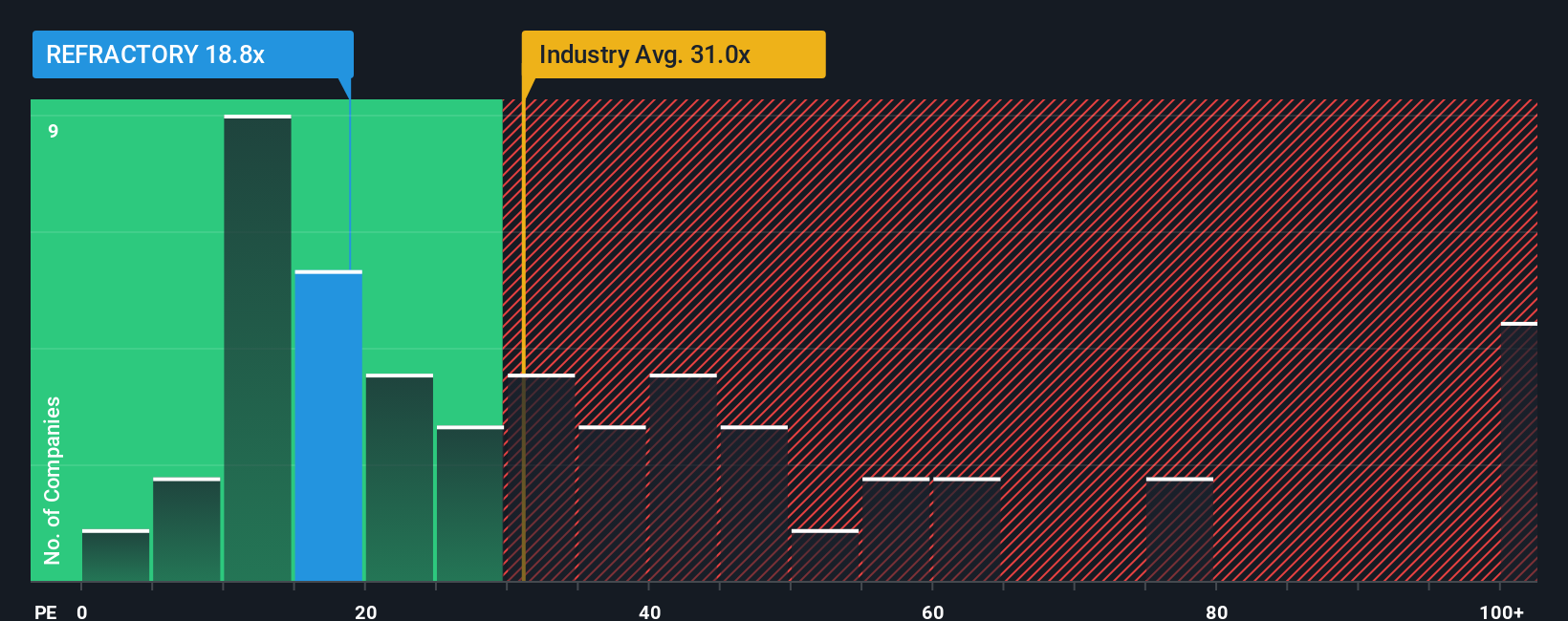

Although its price has surged higher, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 28x, you may still consider Refractory Shapes as an attractive investment with its 18.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Refractory Shapes has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Refractory Shapes

How Is Refractory Shapes' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Refractory Shapes' to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. Pleasingly, EPS has also lifted 58% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Refractory Shapes is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Despite Refractory Shapes' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Refractory Shapes revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Refractory Shapes (1 shouldn't be ignored!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REFRACTORY

Refractory Shapes

Produces special shapes, custom made refractory shapes and ceramic balls of low and medium purity in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives