Should You Be Adding Rashtriya Chemicals and Fertilizers (NSE:RCF) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Rashtriya Chemicals and Fertilizers (NSE:RCF), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Rashtriya Chemicals and Fertilizers

Rashtriya Chemicals and Fertilizers's Improving Profits

Over the last three years, Rashtriya Chemicals and Fertilizers has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Rashtriya Chemicals and Fertilizers's EPS shot from ₹3.75 to ₹6.80, over the last year. You don't see 81% year-on-year growth like that, very often.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Unfortunately, Rashtriya Chemicals and Fertilizers's revenue dropped 15% last year, but the silver lining is that EBIT margins improved from 5.0% to 8.3%. That's not ideal.

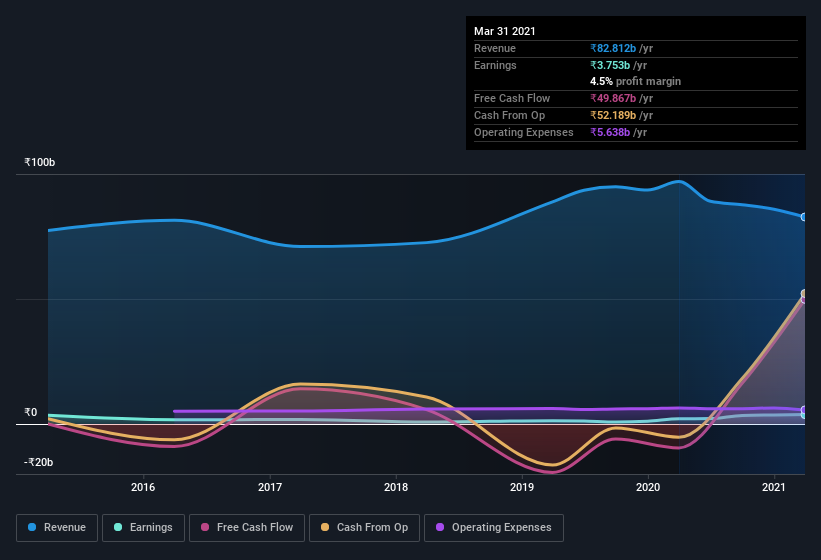

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Rashtriya Chemicals and Fertilizers's balance sheet strength, before getting too excited.

Are Rashtriya Chemicals and Fertilizers Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations between ₹15b and ₹60b, like Rashtriya Chemicals and Fertilizers, the median CEO pay is around ₹24m.

The CEO of Rashtriya Chemicals and Fertilizers was paid just ₹2.5m in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Rashtriya Chemicals and Fertilizers Worth Keeping An Eye On?

Rashtriya Chemicals and Fertilizers's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. So Rashtriya Chemicals and Fertilizers looks like it could be a good quality growth stock, at first glance. That's worth watching. Still, you should learn about the 2 warning signs we've spotted with Rashtriya Chemicals and Fertilizers .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Rashtriya Chemicals and Fertilizers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RCF

Rashtriya Chemicals and Fertilizers

Manufactures, markets, and sells fertilizers and industrial chemicals in India.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives