- India

- /

- Metals and Mining

- /

- NSEI:PRAKASH

Should Income Investors Look At Prakash Industries Limited (NSE:PRAKASH) Before Its Ex-Dividend?

It looks like Prakash Industries Limited (NSE:PRAKASH) is about to go ex-dividend in the next three days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase Prakash Industries' shares on or after the 17th of September will not receive the dividend, which will be paid on the 30th of October.

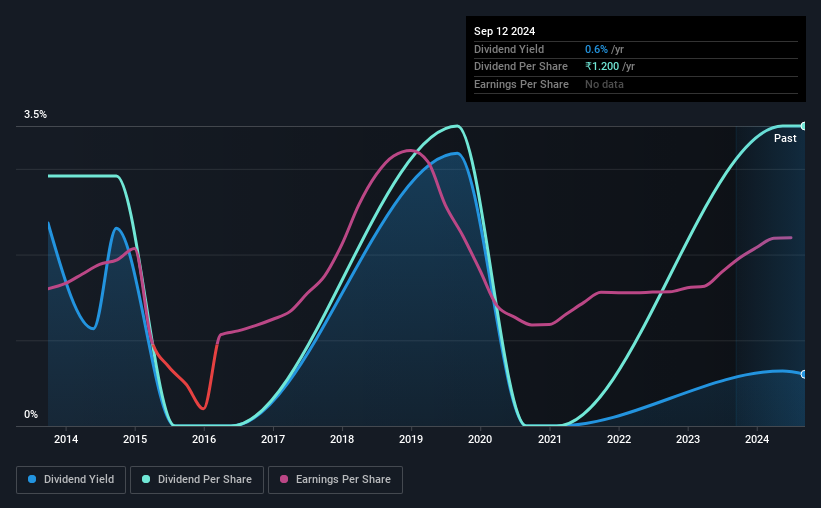

The company's next dividend payment will be ₹1.20 per share, on the back of last year when the company paid a total of ₹1.20 to shareholders. Last year's total dividend payments show that Prakash Industries has a trailing yield of 0.6% on the current share price of ₹198.54. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Prakash Industries can afford its dividend, and if the dividend could grow.

See our latest analysis for Prakash Industries

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Prakash Industries is paying out just 6.2% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Click here to see how much of its profit Prakash Industries paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by Prakash Industries's 10% per annum decline in earnings in the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Prakash Industries has lifted its dividend by approximately 1.8% a year on average.

The Bottom Line

From a dividend perspective, should investors buy or avoid Prakash Industries? Prakash Industries's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. In summary, Prakash Industries appears to have some promise as a dividend stock, and we'd suggest taking a closer look at it.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. In terms of investment risks, we've identified 1 warning sign with Prakash Industries and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PRAKASH

Prakash Industries

Operates as an integrated steel and power company in India.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives