Pinning Down Pidilite Industries Limited's (NSE:PIDILITIND) P/S Is Difficult Right Now

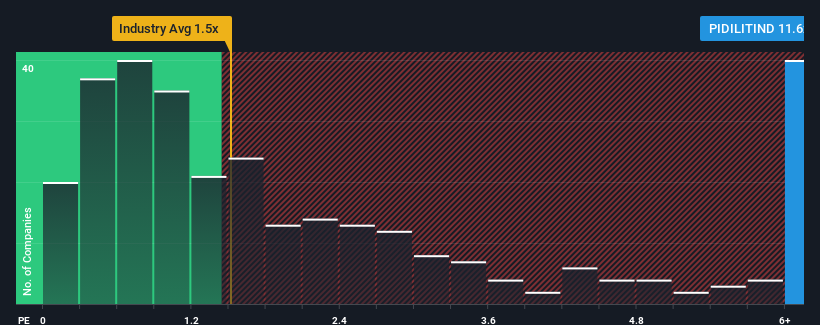

When close to half the companies in the Chemicals industry in India have price-to-sales ratios (or "P/S") below 1.5x, you may consider Pidilite Industries Limited (NSE:PIDILITIND) as a stock to avoid entirely with its 11.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Pidilite Industries

How Pidilite Industries Has Been Performing

There hasn't been much to differentiate Pidilite Industries' and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Pidilite Industries.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Pidilite Industries would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.0% last year. The latest three year period has also seen an excellent 93% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is not materially different.

With this in consideration, we find it intriguing that Pidilite Industries' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Pidilite Industries' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Pidilite Industries' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Pidilite Industries is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PIDILITIND

Pidilite Industries

Engages in the manufacture and sale of consumer and specialty chemicals in India and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.