Does Pearl Polymers (NSE:PEARLPOLY) Have A Healthy Balance Sheet?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Pearl Polymers Limited (NSE:PEARLPOLY) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Pearl Polymers

How Much Debt Does Pearl Polymers Carry?

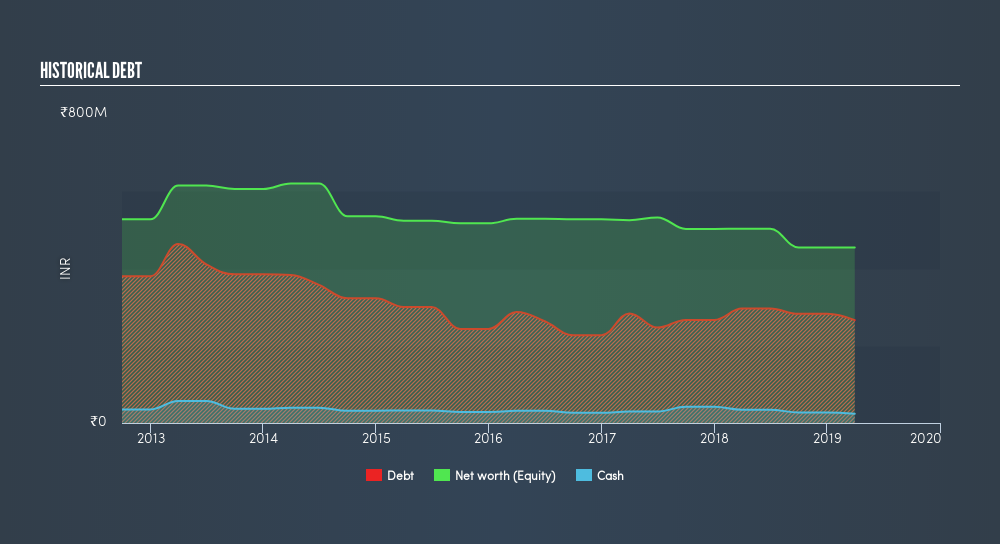

As you can see below, Pearl Polymers had ₹266.2m of debt at March 2019, down from ₹296.2m a year prior. However, because it has a cash reserve of ₹24.1m, its net debt is less, at about ₹242.2m.

A Look At Pearl Polymers's Liabilities

Zooming in on the latest balance sheet data, we can see that Pearl Polymers had liabilities of ₹695.2m due within 12 months and liabilities of ₹112.5m due beyond that. Offsetting these obligations, it had cash of ₹24.1m as well as receivables valued at ₹439.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹344.4m.

When you consider that this deficiency exceeds the company's ₹235.7m market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Since Pearl Polymers does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Pearl Polymers will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Pearl Polymers's revenue was pretty flat. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Pearl Polymers had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost ₹14m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. For example, we would not want to see a repeat of last year's loss of-₹48.6m. And until that time we think this is a risky stock. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Pearl Polymers insider transactions.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:PEARLPOLY

Pearl Polymers

Engages in manufacture and trading of PET bottles, jars, and containers to consumers and industries in India.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives