- India

- /

- Paper and Forestry Products

- /

- NSEI:PDMJEPAPER

A Piece Of The Puzzle Missing From Pudumjee Paper Products Limited's (NSE:PDMJEPAPER) 39% Share Price Climb

Pudumjee Paper Products Limited (NSE:PDMJEPAPER) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. The annual gain comes to 203% following the latest surge, making investors sit up and take notice.

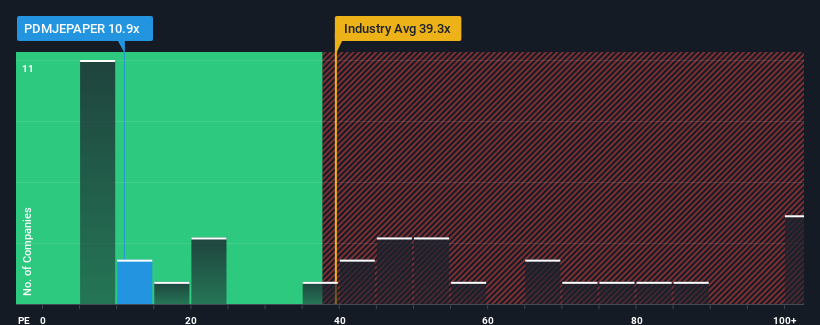

Even after such a large jump in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Pudumjee Paper Products as a highly attractive investment with its 10.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for Pudumjee Paper Products as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Pudumjee Paper Products

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Pudumjee Paper Products' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 142%. The latest three year period has also seen an excellent 189% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Pudumjee Paper Products' P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Pudumjee Paper Products' P/E

Pudumjee Paper Products' recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Pudumjee Paper Products revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Pudumjee Paper Products that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PDMJEPAPER

Pudumjee Paper Products

Manufactures and markets specialty paper products in India.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion