- India

- /

- Metals and Mining

- /

- NSEI:ORIENTCER

Subdued Growth No Barrier To Orient Ceratech Limited (NSE:ORIENTCER) With Shares Advancing 31%

Orient Ceratech Limited (NSE:ORIENTCER) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 73%.

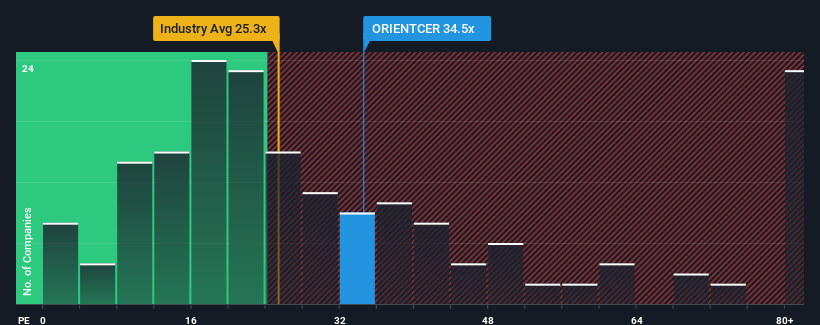

Even after such a large jump in price, it's still not a stretch to say that Orient Ceratech's price-to-earnings (or "P/E") ratio of 34.5x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Orient Ceratech has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Orient Ceratech

Is There Some Growth For Orient Ceratech?

The only time you'd be comfortable seeing a P/E like Orient Ceratech's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. The latest three year period has also seen an excellent 67% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Orient Ceratech is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Orient Ceratech's P/E

Its shares have lifted substantially and now Orient Ceratech's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Orient Ceratech revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Orient Ceratech (of which 2 are potentially serious!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ORIENTCER

Orient Ceratech

Engages in the producing and trading of aluminum refractories and monolithic products in India.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives