As global markets navigate the uncertainties surrounding the incoming Trump administration, small-cap stocks have been particularly sensitive to shifts in policy expectations and economic indicators. With indices like the S&P 600 reflecting these dynamics, investors are keenly observing opportunities that may arise from this volatility. In such an environment, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that can withstand or even capitalize on changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

NOCIL (NSEI:NOCIL)

Simply Wall St Value Rating: ★★★★★★

Overview: NOCIL Limited is involved in the manufacture and sale of rubber chemicals catering to tire and other rubber processing industries both in India and internationally, with a market cap of ₹43.69 billion.

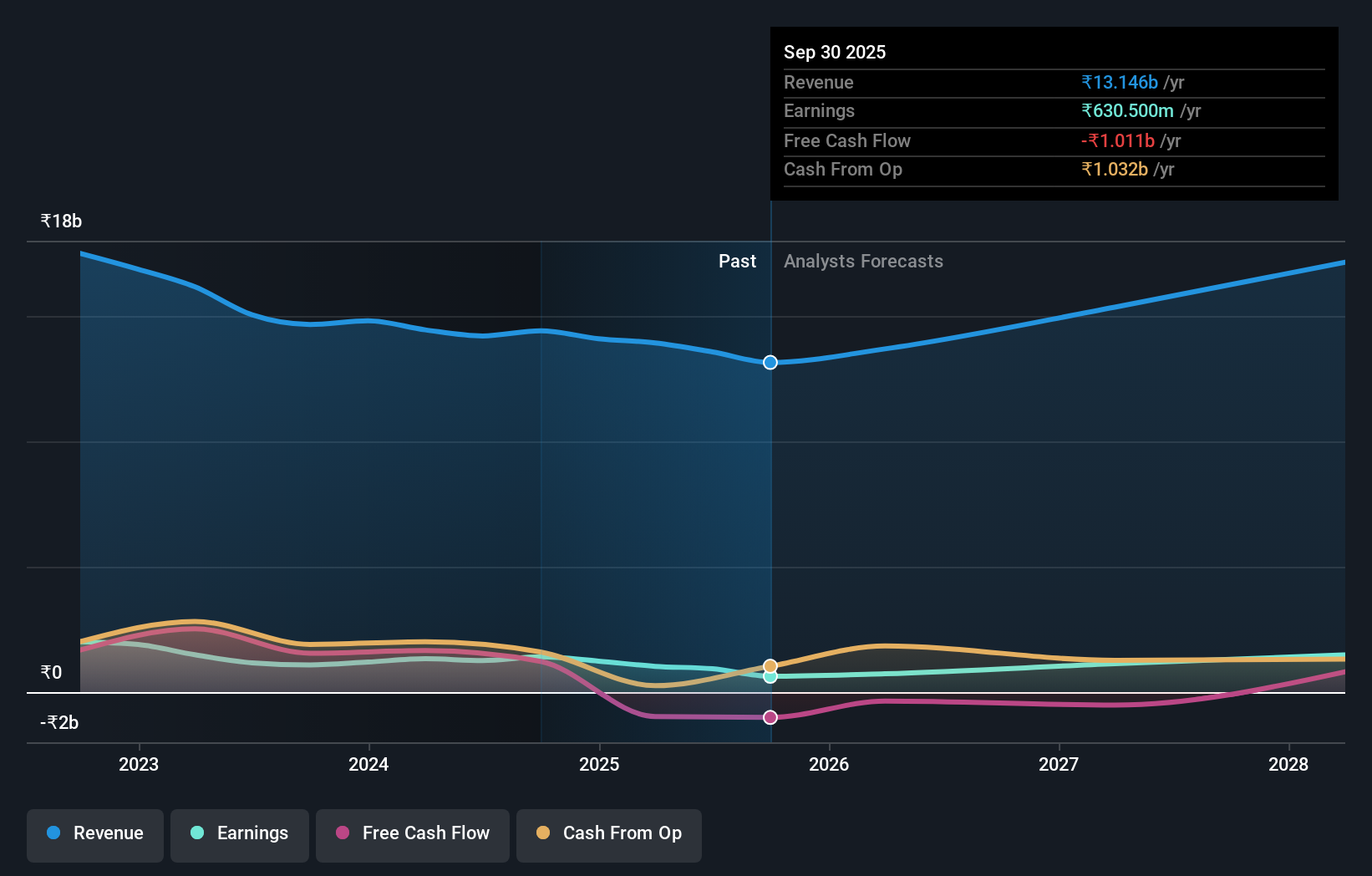

Operations: NOCIL Limited generates revenue primarily from the manufacture of rubber chemicals, amounting to ₹14.41 billion. The company focuses on serving both domestic and international markets within the tire and rubber processing industries.

NOCIL, a promising player in the chemicals sector, has showcased impressive earnings growth of 29.8% over the past year, outpacing the industry average of 7.1%. This small cap company is debt-free and boasts high-quality earnings with a price-to-earnings ratio at 31x, slightly below the industry average of 31.4x. Free cash flow remains positive with recent figures indicating US$1.65 billion as of March 2024, suggesting robust operational efficiency despite capital expenditures around US$344 million in the same period. Looking ahead, NOCIL's earnings are projected to grow by nearly 19% annually, hinting at continued potential for investors seeking growth opportunities within this niche market segment.

- Click to explore a detailed breakdown of our findings in NOCIL's health report.

Understand NOCIL's track record by examining our Past report.

Ashot Ashkelon Industries (TASE:ASHO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ashot Ashkelon Industries Ltd. specializes in the manufacture and sale of systems and components for aerospace and defense sectors both in Israel and internationally, with a market cap of ₪1.18 billion.

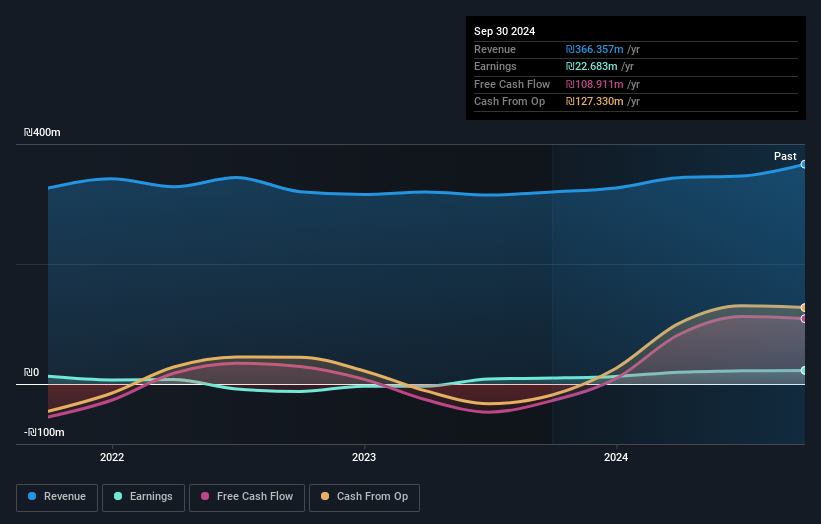

Operations: Ashot Ashkelon generates revenue primarily from its military segment, contributing ₪243.54 million, followed by its aviation segment at ₪86.04 million. The company's subsidiary in the USA adds another ₪65.42 million to the revenue stream.

Ashot Ashkelon Industries, a small player in the Aerospace & Defense sector, has been making waves with its impressive earnings growth of 159.3% over the past year, outpacing industry peers by a significant margin. This company is trading at 86.7% below its estimated fair value, suggesting potential undervaluation in the market. Despite an increase in debt to equity from 6.2% to 7.2% over five years, it maintains a satisfactory net debt to equity ratio of just 2%. With high-quality earnings and well-covered interest payments at 13.6x EBIT coverage, Ashot seems poised for continued financial stability amid market volatility.

Archicom (WSE:ARH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Archicom S.A. operates in the real estate sector in Poland with a market capitalization of PLN2.05 billion.

Operations: Archicom S.A. generates revenue primarily from its real estate activities in Poland. The company's financial performance is reflected in its market capitalization of PLN2.05 billion, although specific revenue streams and cost breakdowns are not detailed here.

Archicom, a relatively small player in the market, has shown impressive earnings growth of 129.6% over the past year, outpacing its industry peers. However, its net debt to equity ratio stands at 44.3%, which is considered high and suggests potential financial leverage concerns. Despite this, Archicom's interest payments are comfortably covered by EBIT at a robust 135.3x coverage. Recent results showed revenue jumping to PLN 325 million for the half-year ending June 2024 from PLN 219 million previously, though net income dipped to PLN 40 million from PLN 55 million last year, indicating some profitability challenges amidst growth efforts.

- Click here to discover the nuances of Archicom with our detailed analytical health report.

Review our historical performance report to gain insights into Archicom's's past performance.

Summing It All Up

- Navigate through the entire inventory of 4639 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOCIL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NOCIL

NOCIL

Engages in the manufacture and sale of rubber chemicals for tire, automotive, rubber goods, and industrial sectors in India and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.