Nilkamal Limited (NSE:NILKAMAL) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Nilkamal (NSE:NILKAMAL) has had a great run on the share market with its stock up by a significant 32% over the last three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Specifically, we decided to study Nilkamal's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Nilkamal

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Nilkamal is:

10% = ₹1.1b ÷ ₹11b (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.10.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Nilkamal's Earnings Growth And 10% ROE

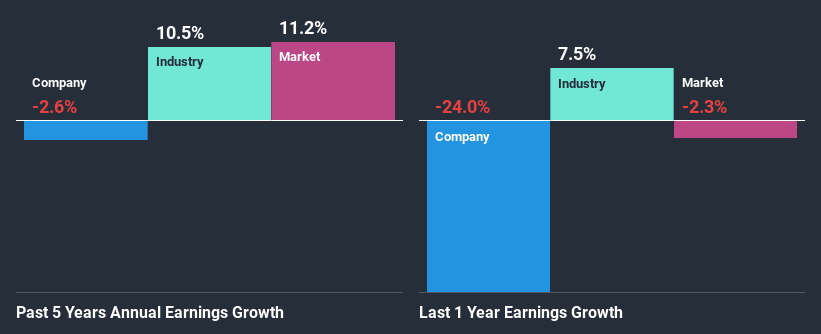

When you first look at it, Nilkamal's ROE doesn't look that attractive. However, given that the company's ROE is similar to the average industry ROE of 10%, we may spare it some thought. But Nilkamal saw a five year net income decline of 2.6% over the past five years. Remember, the company's ROE is a bit low to begin with. So that's what might be causing earnings growth to shrink.

So, as a next step, we compared Nilkamal's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 10% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Nilkamal's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Nilkamal Making Efficient Use Of Its Profits?

Nilkamal's low three-year median payout ratio of 16% (implying that it retains the remaining 84% of its profits) comes as a surprise when you pair it with the shrinking earnings. This typically shouldn't be the case when a company is retaining most of its earnings. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

Additionally, Nilkamal has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 16% of its profits over the next three years. However, Nilkamal's ROE is predicted to rise to 15% despite there being no anticipated change in its payout ratio.

Summary

In total, we're a bit ambivalent about Nilkamal's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

When trading Nilkamal or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nilkamal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NILKAMAL

Nilkamal

Manufactures and sells plastic products in India and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives